China Rebalancing in Reverse

In an effort to meet an absurd growth target of 6.5%, credit growth in China exploded to an all-time high, nearly half a trillion in US dollar terms in a single month!

The Financial Times reports China Bank Lending Hits Record in January.

China’s banks granted loans at the fastest pace on record in January, a sign that the government is loosening monetary policy more aggressively in an attempt to bolster the slowing economy.

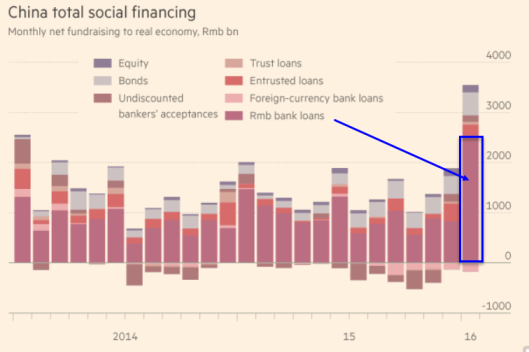

New local currency bank loans to the real economy set a monthly record at Rmb2.54tn ($390bn). Credit from all sources, including bonds and off-balance-sheet lending, reached Rmb3.22tn, also a monthly record, with corporate bond issuance at an all-time high.

“Judging from recent speeches by top leaders and January’s credit growth, this year policymakers seem to be determined to make the economy grow above their bottom line of 6.5 per cent,” Larry Hu, China economist at Macquarie Securities, wrote on Tuesday.

Renminbi depreciation may also have boosted demand for loans. In the years when the renminbi was viewed as a one-way bet to appreciate, companies were eager to borrow in dollars, since the debt burden was expected to be lighter in renminbi terms when the loan came due.

Now, the opposite dynamic is at play, and many Chinese companies are borrowing in renminbi to replace foreign currency debt.

China Total Lending

To be fair some of that jump is seasonal. Lending typically jumps around the Chinese new year.

Still, this increase in lending dwarfs any previous records, especially yuan-based bank loans.

Bad Loans Highest in Decade

Bloomberg reports China’s Bad Loans Rise to Highest in a Decade as Economy Slows.

Soured loans at Chinese commercial banks rose to the highest level since June 2006 as the nation’s economic expansion slowed to the weakest pace in a quarter century.

Nonperforming loans jumped by 51% last year from end of 2014.

Separately, the People’s Bank of China reported Tuesday that new credit surged in January to a record 3.42 trillion yuan, almost double the amount in December and exceeding the median forecast of 2.2 trillion yuan in a Bloomberg survey of analysts. The increase was linked to a seasonal binge as banks front-loaded lending and Chinese borrowers refinanced foreign-denominated debt.

The CBRC data comes amid speculation that soured loans could be much larger than indicated by official data. Kyle Bass, a hedge fund manager who successfully bet against mortgages during the subprime collapse, said earlier this month that the Chinese banking system may see losses of more than four times those suffered by U.S. lenders during the 2008 credit crisis. That claim has been disputed by DBS’s Chen and analysts at China International Capital Corp and Macquarie Securities Ltd.

Should the Chinese banking system lose 10 percent of its assets because of nonperforming loans, the nation’s banks will see about $3.5 trillion in their equity vanish, Bass, the founder of Dallas-based Hayman Capital Management, wrote this month in a letter to investors obtained by Bloomberg. Larry Hu, a China economist at Macquarie in Hong Kong, said in a research note on Monday that Bass’s estimate could be too large as it implied a true bad-loan ratio for China banks at 28 to 30 percent.

Leave A Comment