This daily digest focuses on Yuan rates, major Chinese economic data, market sentiment, new developments in China’s foreign exchange policies, changes in financial market regulations, as well as market news typically available only in Chinese-language sources.

Yuan Rates

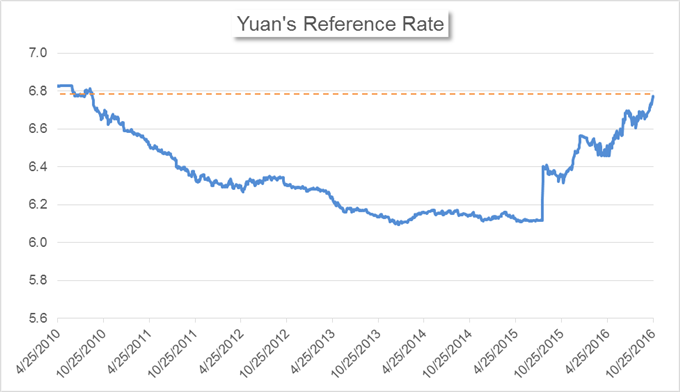

– The PBOC weakened the Yuan against the U.S. Dollar for the third trading day in a row on Tuesday, setting a new six-year low for the reference rate. The Yuan was lowered by -54 pips or -0.08% against the Dollar to 6.7744. Within one hour following the release of the Yuan fix, the offshore Yuan strengthened +0.07% against the Greenback to 6.7818, 74 pips weaker than the guided level.

Data downloaded from Bloomberg; chart prepared by Renee Mu.

The PBOC injected 115 billion Yuan of 7-day reverse repos, 85 billion Yuan of 14-day reverse repos and 35 billion Yuan of 28-day reverse repos on Tuesday. After deducting the 60 billion Yuan of reverse repos matured on the day, the net liquidity added was 175 billion Yuan. This is the fifth day in a row with a net cash injection. However, the tight liquidity condition has not been fully erased; Yuan’s borrowing costs in the short-term and medium-term continued to rise on Tuesday. In specific, Yuan’s overnight funding cost in the Shanghai interbank market increased +0.70 BP to 2.2380%. Amid the shortage of liquidity, it is expected that the Central Bank will continue to pump money into the market in the rest of the week.

Data downloaded from Bloomberg; chart prepared by Renee Mu.

Market News

People’s Daily: the official paper of the Communist Party.

– The Deputy Governor of the PBOC, Yi Gang, commented on the Yuan on October 25th after Yuan pairs hit fresh lows. He said that “there is no basis for a persistent Yuan devaluation. Compared to other currencies that either have a reserve currency status or are convertible, the Chinese Yuan has remained stable. Compared to currencies of emerging economies, the Yuan shows even stronger stability. From a long-term perspective, the flexibility of Dollar/Yuan rates saw increases, but the volatility in Yuan pairs is still smaller than most of the reserve currencies and emerging-market currencies.”

Leave A Comment