The Madness of QE

BALTIMORE – Like a house on fire, the election continues to draw a crowd of gawkers. We joined them for the final debate, warming our hands and hoping to see the whole damned place burn down.

Like the ancient serpent deity Glycon (whom we have discussed previously), the candidates promised miracles galore: they shall tell fortunes, help find fugitive slaves, detect thieves and robbers, cause the discovery of treasures, heal the sick, and raise the dead. It will be a glorious future!

The debate brought a shift to policy issues. But, as usual, it was a pathetic discussion. One, a slick, conniving pro with more jackass solutions to the problems she helped cause. The other, floundering, unable to form a coherent critique of his opponent’s claptrap programs.

Both of them offered to heal the sick, enrich the poor, and raise the dead. Occasionally, by accident, an intelligent idea came running out of the house with its hair on fire; the candidates quickly shot it dead.

Hillary’s Deep State economics don’t work. We’ve been arguing for years that fixing the price of credit by central banks would have the same consequences as fixing any other price: disaster.

If you set the price of credit too high, borrowing gets too expensive, and the shelves groan with unsold inventory as you punish demand. If you set the price too low, buyers are happy at first, until the manufacturer gets tired of taking losses and the product disappears.

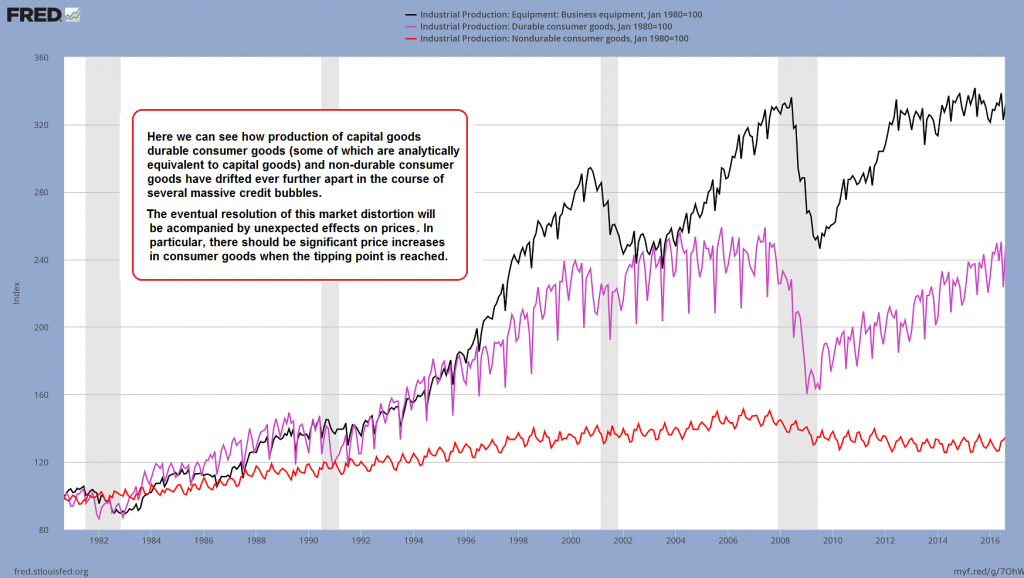

The influence of serial credit bubbles on the economy’s structure of production: the resources devotes to capital goods and consumer goods production have kept drifting apart in favor of the former and to the detriment of the latter. If one scours the internet for things to buy, there is always a wealth of goods to choose from. And yet, we have noticed – this is a purely anecdotal observation, mind – that increasingly often, these products are actually no longer available

Leave A Comment