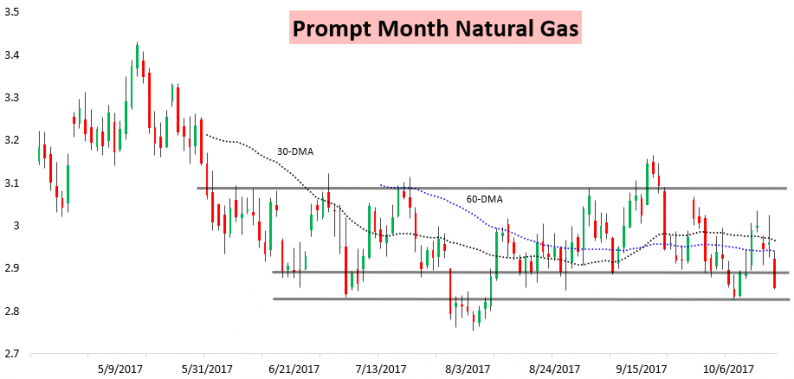

Again today we saw natural gas prices come under heavy selling pressure as longer-range forecasts eliminated the heating demand that we see in the medium-term forecast. The result was a break below one of our near-term support levels at $2.88 which opens up room for a re-test of $2.83.

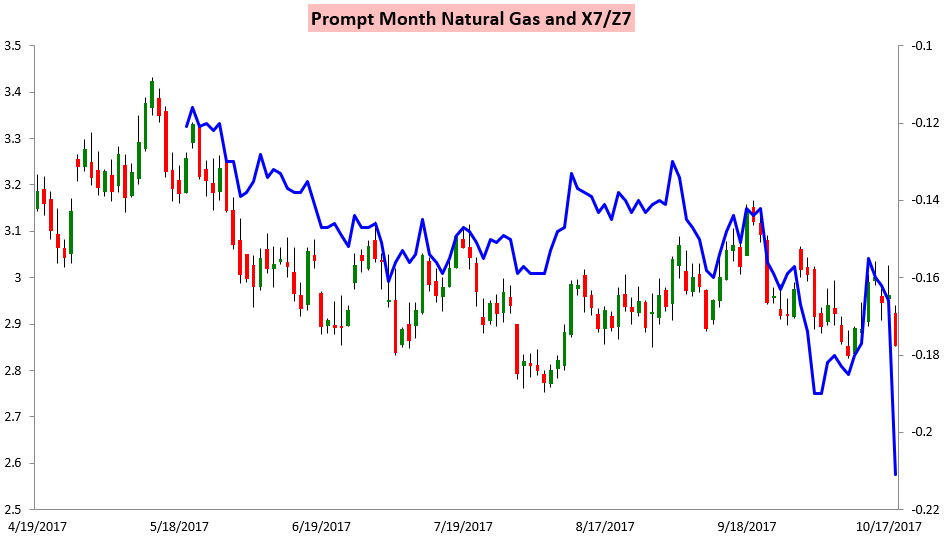

One easy way to see the impact of the weather is on the X7/Z7 spread, which has widened significantly as of late. As heating demand expectations to close out October have fallen, it has become clear that this medium-range demand spike will not be sustained and into early November weather-driven natural gas demand will be limited. The result, then, is less interest in holding the prompt month November natural gas contract, though the December natural gas contract continues to price in the potential that we turn colder sometime in November. The large move in X/Z today shows just how much bearish weather expectations drove price action.

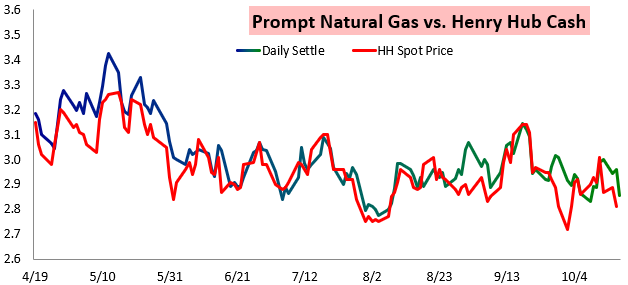

This selling came amidst weak cash prices as well, as weather-driven demand will be quite low over the next week.

We can even see that the move lower today in prompt month futures was relatively proportional to the move down in cash prices, with only a small weather premium being priced in (with prompt month prices sitting just slightly above cash prices).

Yet longer-term destruction along the natural gas strip was not as impressive. Despite the impressive decline in X/Z today, H/J moved down just a couple cents, indicating that the natural gas market is still a bit concerned about structural tightness and the recent selling near the front of the strip is driven by expectations of limited heating demand just into early November.

In this way, we saw the short-term “weather premium” diminish significantly the last couple days (with prompt and cash prices moving closer together) but the longer-term “winter premium” did not make nearly as significant a move. It is this kind of understanding that can allow us to see what kind of weather shifts the natural gas market will react to and how far out in time the market seems to be focusing; here the market realized structural tightness and still sees seasonal cold risks but is concerned about anemic closer-term demand to end October.

Leave A Comment