The U.S. stock market indexes gained 0.1-0.3% on Wednesday, extending their short-term consolidation, as investors continued to hesitate ahead of tomorrow’s monthly jobs data release. The S&P 500 index has reached the new record high of 2,940.91 on September the 21st. It currently trades just 0.5% below that high. The Dow Jones Industrial Average gained 0.2% and the technology Nasdaq Composite gained 0.3% yesterday.

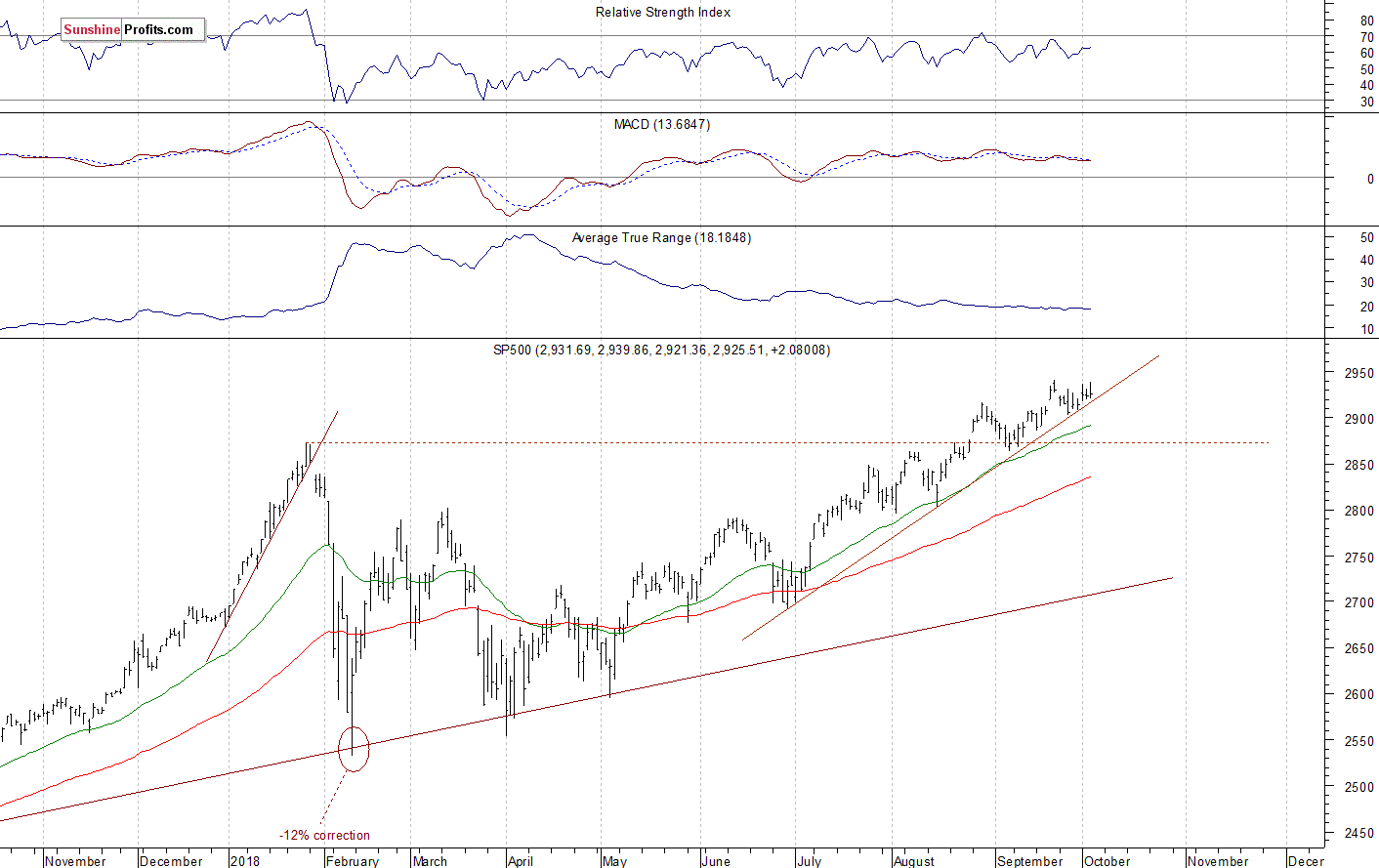

The nearest important level of support of the S&P 500 index remains at around 2,915-2,920, marked by the recent consolidation and the medium-term upward trend line. The next support level is at 2,900. The support level is also at 2,885-2,890. On the other hand, the nearest important level of resistance remains at around 2,925-2,930, marked by the last week’s Monday’s daily gap down of 2,923.79-2,927.11. The resistance level is also at 2,940, marked by the record high.

The broad stock market reached the new record high in the late September, as the S&P 500 index extended its short-term uptrend above the level of 2,900. Will it continue higher despite some short-term technical overbought conditions? The index keeps bouncing off its three-month-long upward trend line following last Wednesday’s upward reversal, as we can see on the daily chart:

Negative Expectations

Expectations before the opening of today’s trading session are negative, because the index futures contracts trade 0.3-0.5% below their yesterday’s closing prices. The European stock market indexes have lost 0.3-0.9% so far. Investors will wait for some economic data announcements today: Initial Claims at 8:30 a.m., Factory Orders at 10:00 a.m. The broad stock market will likely continue to fluctuate after the recent record-breaking advance. Will the index break above the mentioned September’s record high? It’s hard to say. If it breaks higher, we could see more buying pressure. There have been no confirmed negative signals so far.

Leave A Comment