This daily digest focuses on Yuan rates, major Chinese economic data, market sentiment, new developments in China’s foreign exchange policies, changes in financial market regulations, as well as market news typically available only in Chinese-language sources.

– The offshore Yuan finds resistance along the top side of a parallel extending off the August high.

– Yuan deposits in Hong Kong picked up in October following three consecutive drops.

– The Deputy Governor of the PBOC reiterated that “there is no basis for a persistent Yuan devaluation” on Monday.

Yuan Rates

– The PBOC fixed the Yuan by +217 pips or +0.32% stronger against the U.S. Dollar to 6.7641 on Monday, the largest daily increase in a month. Following the guidance, the offshore Yuan strengthened against its U.S counterpart, with the USD/CNH dropping to 6.7882 from 6.7955 within one hour after the release. The offshore pair found resistance along the top side of a parallel extending off the August high.

Prepared by Renee Mu.

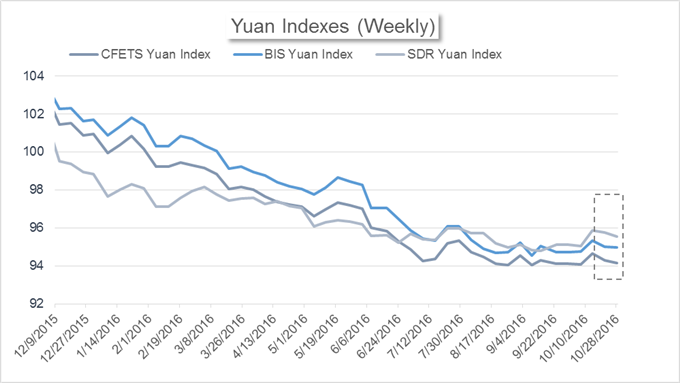

Over the past week, the Yuan extended losses against a basket of currencies. The CFETS Yuan Index, BIS Yuan Index and SDR Yuan Index dropped -0.15%, -0.03% and -0.21% respectively. However, on a monthly basis, the Yuan still gains against all the three baskets, up by +0.04%, +0.25% and +0.47% respectively; over the same span of time, the Yuan fell -1.60% offshore and -1.61% onshore. This shows Yuan’s stability against a portfolio of currencies despite the largest monthly drop against the U.S. Dollar since the de-pegging on August 11, 2015.

Data downloaded from Bloomberg; chart prepared by Renee Mu.

Key Economic Indicators

– Yuan-denominated deposits in Hong Kong increased +1.93% in October, following three consecutive drops, according to a report released by Hong Kong Monetary Authority on Monday. This indicates that after the Yuan’s official inclusion in the SDR basket, investors increased interests in holding Yuan assets.

Leave A Comment