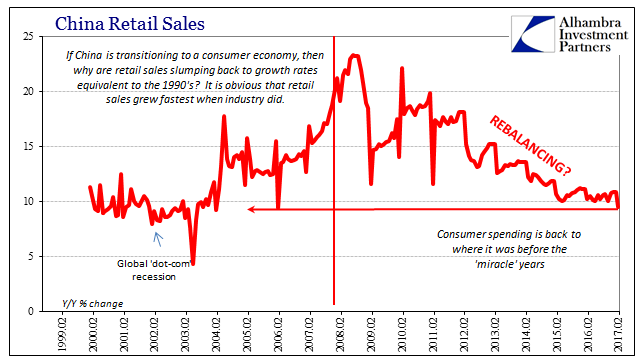

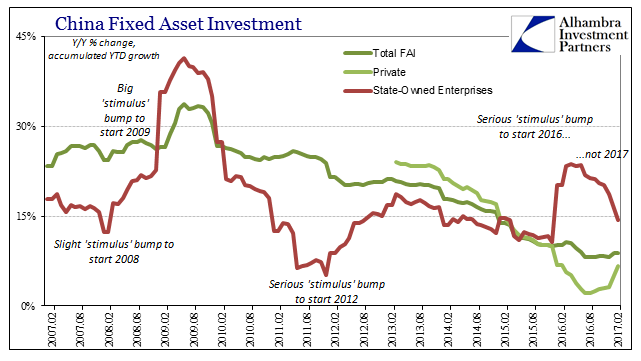

The first major economic data of 2017 from China was highly disappointing to expectations of either stability or hopes for actual acceleration. On all counts for the combined January-February period, the big three statistics missed: Industrial Production was 6.3%, Fixed Asset Investment 8.9%, and Retail Sales just 9.5%. For retail sales, the primary avenue for what is supposed to be a “rebalancing” Chinese economy, that was the lowest growth rate in more than a decade, the first time below 10% since the January-February period in 2006.

Analysts had been expecting Chinese retail sales to rise either 10.5% or 10.6%, depending on the source collating expectations, meaning that actual sales missed by a wide margin during the holiday period. What was perhaps most noteworthy was the growing dichotomy between online sales and retail sales overall. Virtual sales rose by more than 25% year-over-year, echoing a similar dynamic we have observed in US retail sales since early last year. Consumer prices according to government statistics have been stable (and actually decelerated sharply recently) and therefore different than in the US, so it might not suggest the same oil price effects as here but instead a similar underlying baseline weakness that hasn’t dissipated even though the worst of the “rising dollar” is now a year in the past.

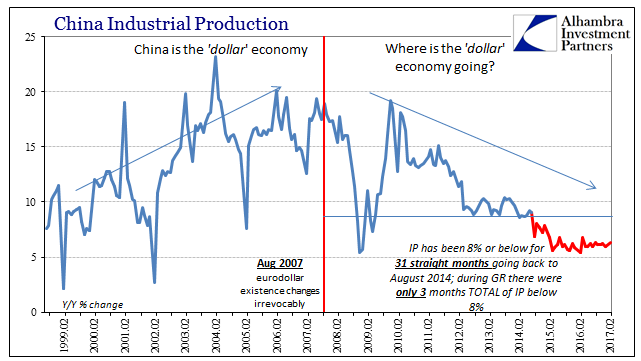

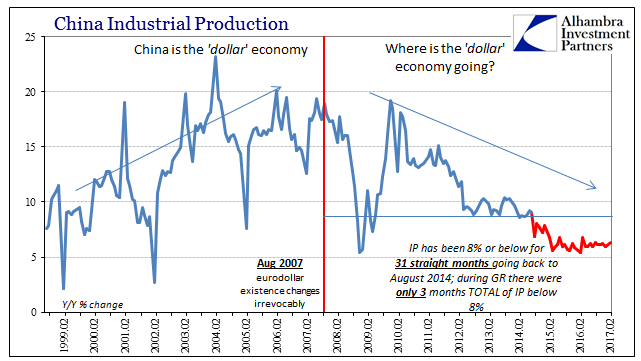

The rest of China’s statistics propose the same assumptions. Industrial production at 6.3% is no different at all than the level of growth it has been for two years now. The noticeable lack of volatility in the changes month-to-month continues to suggest (louder) less reliability, perhaps, than might be hoped for (like China’s GDP estimates). If there were actually some appreciable acceleration in Chinese industry we would expect to see it here, meaning that it is very likely only the downside that might be obscured by an almost perfect and increasingly likely artificial sideways trend.

Leave A Comment