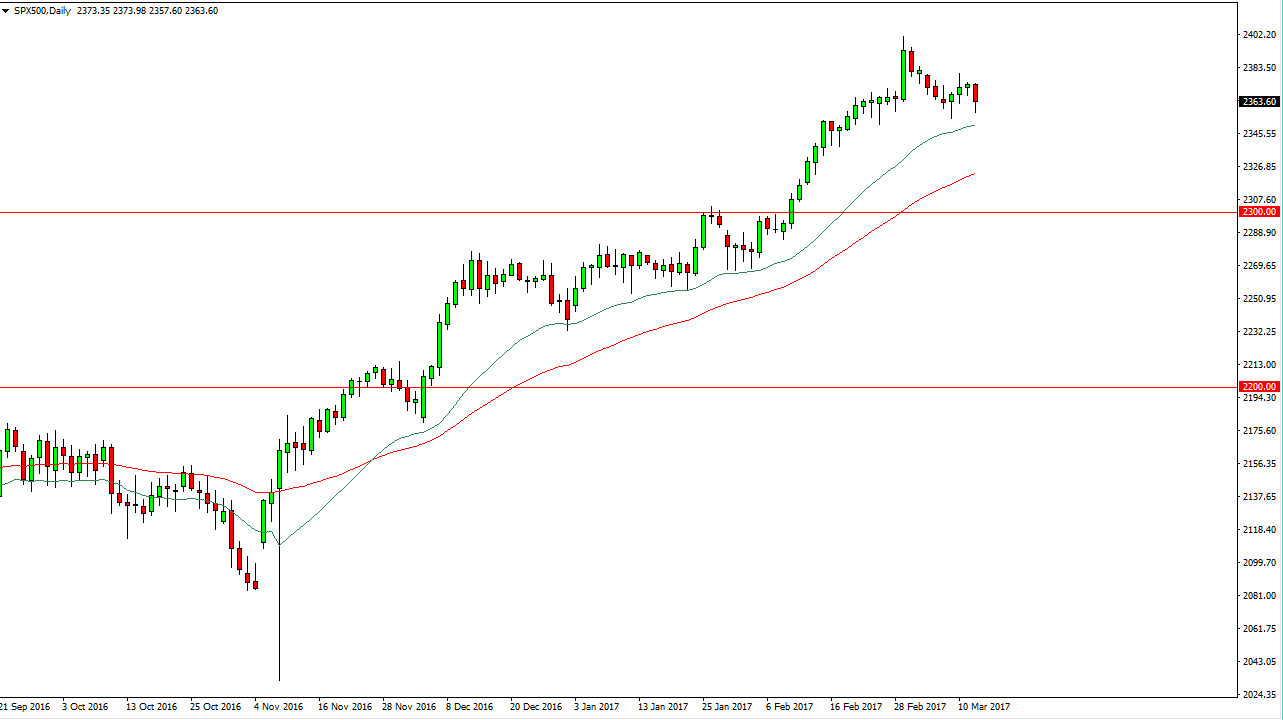

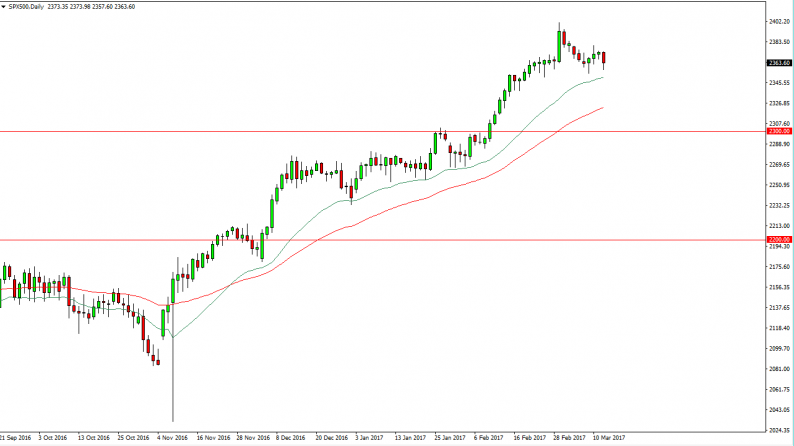

S&P 500

The S&P 500 fell a bit during the day on Tuesday, but we still have plenty of support just below. I believe the 2050 level underneath it should be rather supportive, just as the 20-day exponential moving average just underneath that level should be. Because of this, I’m waiting to see a buying opportunity in the form of either a supportive daily close, or perhaps a bounce. The FOMC Statement coming out today of course could have implications in this market, but I believe any type of negative reaction will more than likely end up being a nice buying opportunity. The 2300 level below should be the “basement” on the market going forward. I have a target of 2400, followed by 2500.

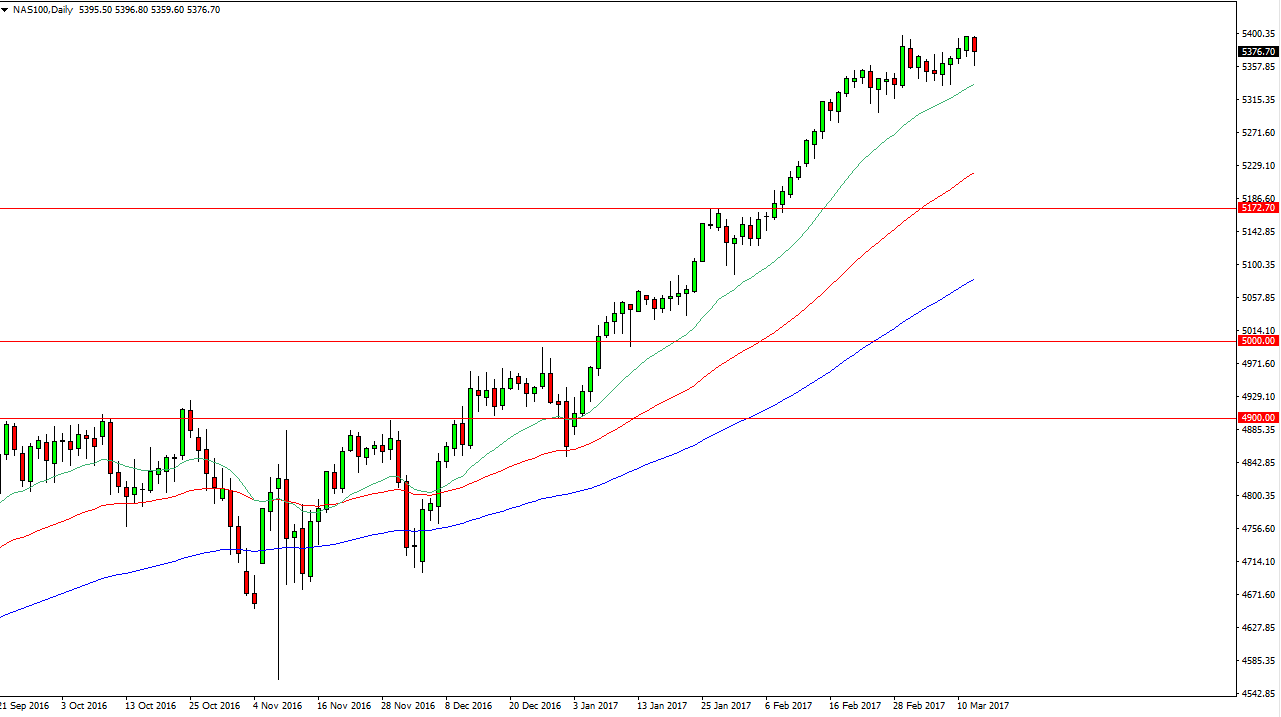

Nasdaq 100

The Nasdaq 100 continues to go back and forth, as the Tuesday session showed a bit of a slowdown. However, I think that part of this is due to the overbought conditions more than anything else, and that it will eventually continue the uptrend that we have seen lately. The 20-day exponential moving average seems to attract a lot of attention, and I think that the area could offer dynamic support. Also, the Federal Reserve will have a statement today that can move the needle. Nonetheless, I think that any pullback at this point is value that you should be looking to buy. The 5500 level is still my longer-term target, with the 5400 level being a place where there will be some resistance.

Leave A Comment