Colgate-Palmolive Co. (CL – Free Report) posted adjusted earnings of 75 cents a share in fourth-quarter 2017, in line with the Zacks Consensus Estimate and flat with the prior-year quarter. Including one-time items, earnings came in at 37 cents a share compared with 68 cents reported in the year-ago period.

Total sales of $3,892 million improved 4.5% from the year-ago period but lagged the Zacks Consensus Estimate of $3,916 million. The top line gained from 3% increase in global unit volumes and favorable currency impact of 2.5%, offset by 1% decline in pricing. Further, strong volume gains in Latin America, North America and Europe aided sales growth.

On an organic basis (excluding foreign exchange, acquisitions and divestitures), the company’s sales jumped 2%.

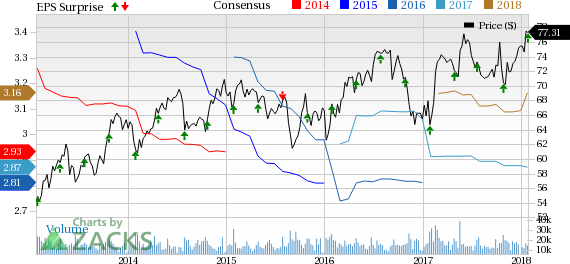

Colgate-Palmolive Company Price, Consensus and EPS Surprise

|

Following the earnings release, Colgate’s shares declined 3.6% in the pre-market trading hours. However, the stock has increased 9.8% in the last three months, outperforming the broader industry’s growth of 3.8%.

Deeper Insight

Adjusted gross profit margin of 60.4% contracted 40 basis points (bps) from the prior-year quarter driven by higher raw and packaging material expenses and lower pricing. However, this was partially offset by gains from the cost-saving initiatives under the company’s funding-the-growth program.

In the reported quarter, adjusted operating profit of $1,011 million dipped 3%, with the adjusted operating margin contracting 190 basis points (bps) to 26%. Operating margin decline can be attributed to 160 bps rise in adjusted selling, general & administrative expenses as a percentage of sales, which included higher investments in advertising.

Year to date, Colgate’s market share of manual toothbrushes has reached 32.6%. Further, the company continued with its leadership in the global toothpaste market with 43.3% market share year to date.

Leave A Comment