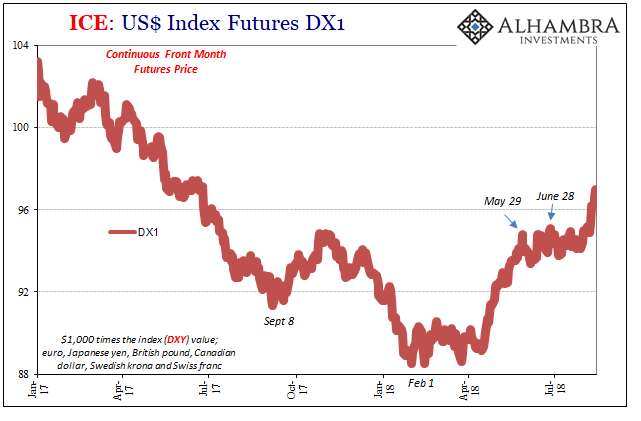

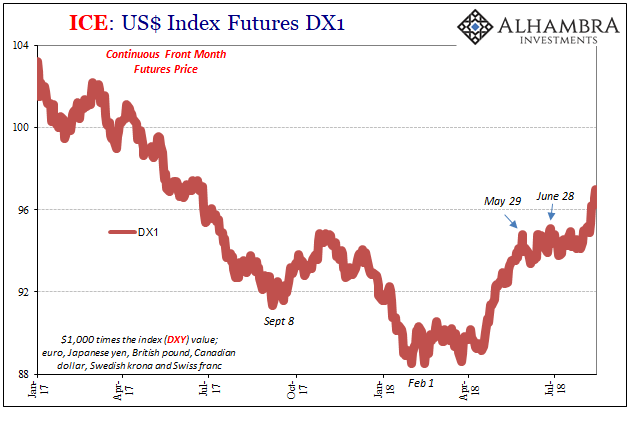

It was never really all that much. The best that might have been said was that it was a pause in the building of renewed deflationary pressures. The dollar had “risen” again especially in April and May but then traded sideways through July. It wasn’t a rebound or even much that was positive, just less immediate heaviness.

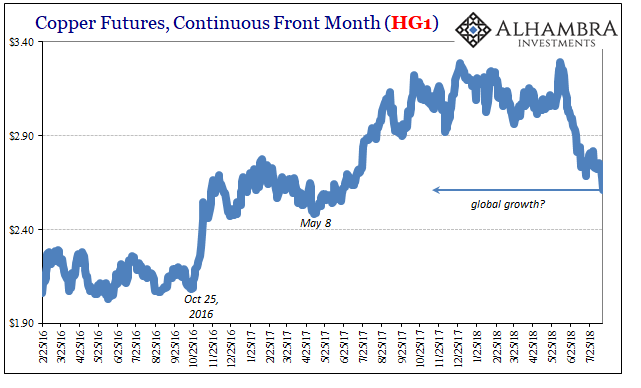

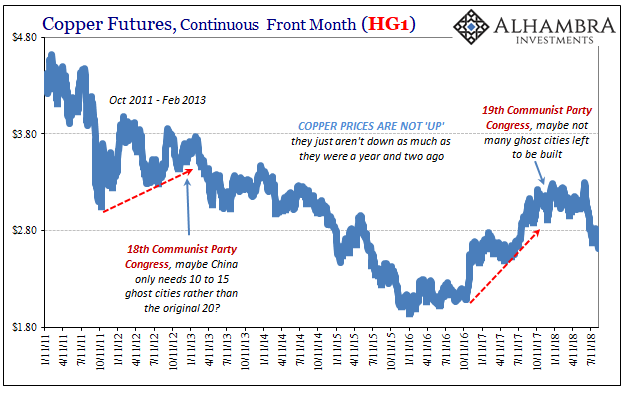

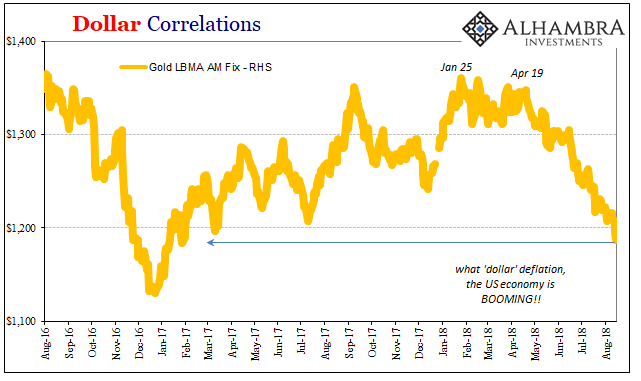

That appears to be over with now in August; always August. The dollar is on the move which means the eurodollar is deficient. The squeeze is back and it is being felt almost across the board. Copper is down again as is gold. The metals are and have been for years, quite clear as to what all this is.

QE has merely clouded the issue. People believe central banks have printed money so how can there be any small levels of deflation let alone year after year of it? You hear it all the time how monetary officials have “flooded” the world with liquidity, yet when you step outside that purposeful narrative you see it cannot have been true.

That’s not enough, however. We want to know how and why. Unlike central bankers, we strive to be competent about money and therefore the economy. It is the Ben Bernanke’s of the world who are content to draw simple diagrams and believe in singularly isolated correlations without investigating the actual mechanics behind this world.

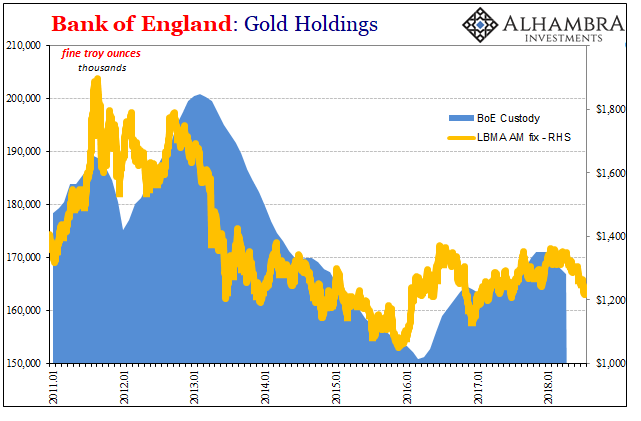

One thing we do know is that gold is leaving the custody of the Bank of England again. It is a pretty reliable signal that commercial banks are using the metal for other means. What other means? Collateral as last resort.

It is one part for the mechanisms of deflation that have on and off plagued the global money system since it broke down eleven Augusts ago. A credit-based monetary system requires credit-based institutions to do credit-based things. In the modern version, it is heavily reliant upon interbank funding.

This type of management system is quite different than its depository ancestor. These interbank markets are really the means for redistributing monetary characteristics wherever market signals suggest they are demanded and often necessary. Sometimes that means cash, sometimes more esoteric forms of liquidity like collateral.

Leave A Comment