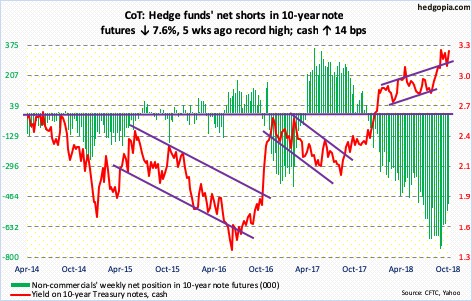

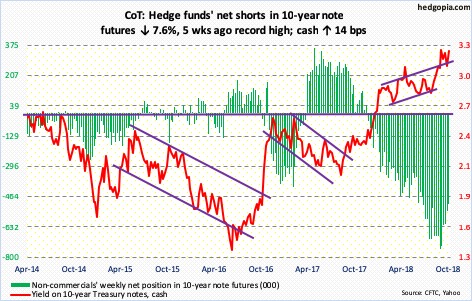

Following futures positions of non-commercials are as of October 30, 2018.

10-year note: Currently net short 502.8k, down 41.2k.

The 10-year Treasury rate continues to trade in a no-man’s land. Sort of. On October 5, it began retreating after touching 3.25 percent. That was the highest since May 2011. Then by the 26th, it was down to 3.06 percent, before bond bears showed up just under the daily lower Bollinger band.

Yields ended the week at 3.21 percent, up seven basis points Friday in reaction to October’s jobs report, which showed average hourly earnings rose 3.1 percent year-over-year in October, the first time wages grew with a three handle since April 2009. On the 10-year, short-term support lies at 3.11 percent. This level also approximates the upper bound of a multi-year rising wedge. The lower bound lies near three percent.

Non-commercials obviously hope yields continue higher, and are positioned accordingly. Over the past several weeks, they have cut back net shorts in 10-year notes, but holdings remain massive. Currently, the 10-year hovers near the upper bound, but a wedge breakdown at some point in the future exposes them to the risk of a squeeze.

30-year bond: Currently net short 82k, down 5.8k.

Major economic releases next week are as follows.

The ISM non-manufacturing index for October is due out Monday. Services activity in September jumped 3.1 points month-over-month to 61.6, which is the highest ever, although data only goes back to January 2008.

September’s JOLTS is scheduled for Tuesday. In August, non-farm job openings rose 59,000 m/m to 7.14 million – a new record.

Also Tuesday, mid-term elections are held.

Wednesday, the FOMC meets; the meeting concludes the next day. No hike is expected. The fed funds rate went up 25 basis points in September, to a range of 200 to 225 basis points. Markets expect a raise in December (18-19), with futures pricing in 79-percent probability.

Friday brings core PPI (October) and University of Michigan’s consumer sentiment index (November, preliminary).

Producer prices rose 0.2 percent m/m in September and 2.6 percent in the 12 months to September. Core PPI increased 0.4 percent and 2.9 percent in the 12 months through September.

Consumer sentiment dropped 1.5 points m/m in October to 98.6. March’s 101.4 was the highest since 103.8 in January 2004.

Leave A Comment