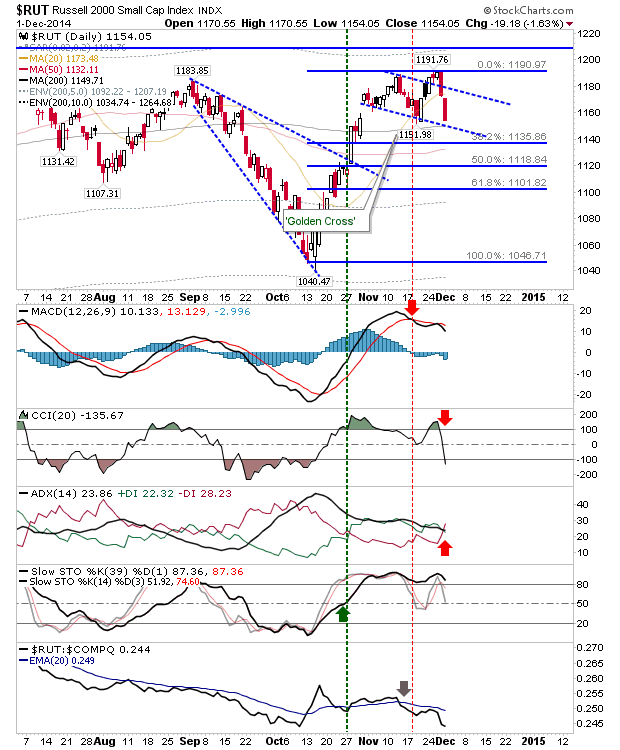

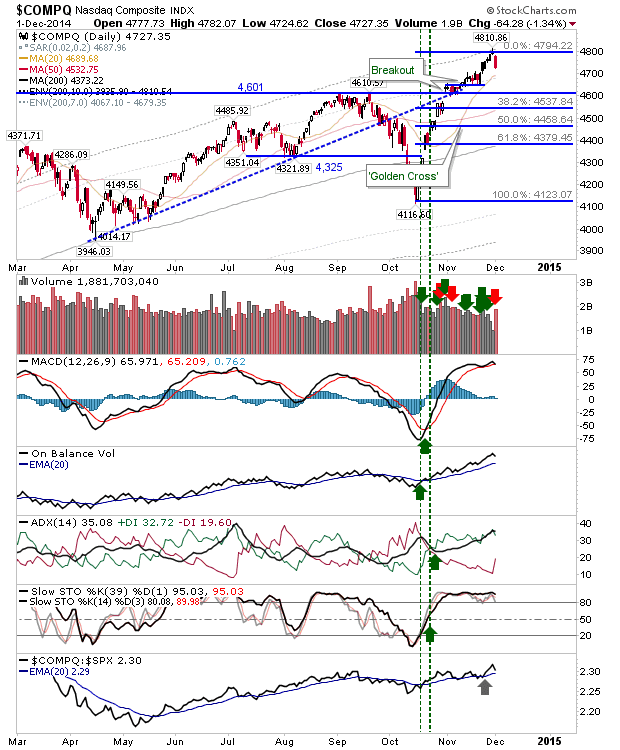

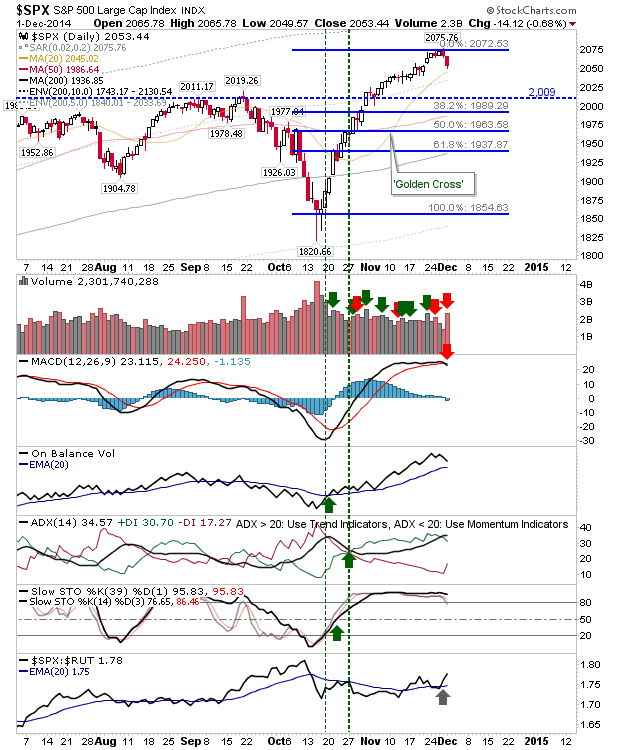

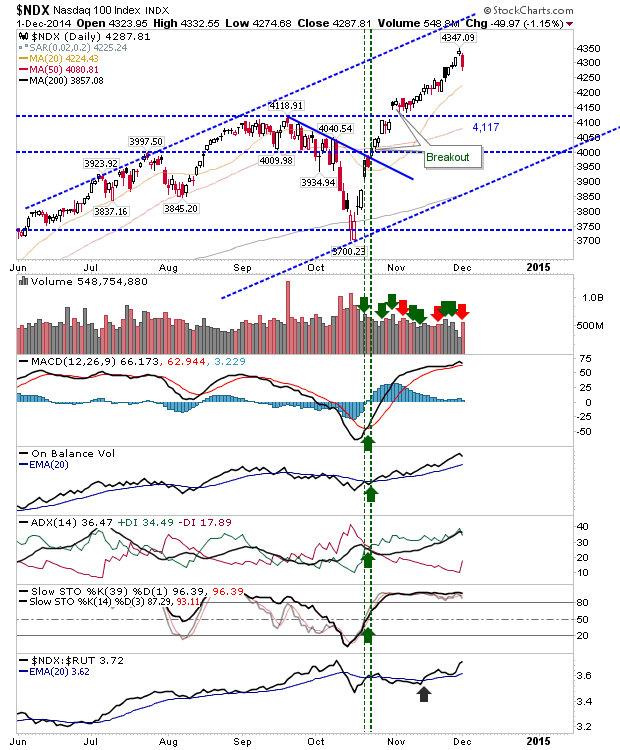

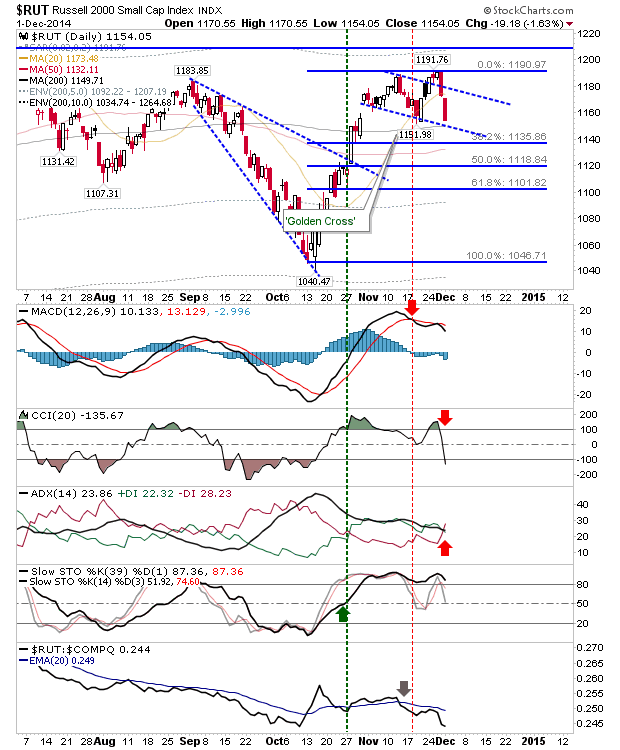

It has been a while, but markets had their first day of distribution in weeks. The selling didn’t clock up big percentage losses, although the Russell 2000 suffered the worst of the selling. There was still a case of post-holiday trading volume, but many indices are looking at ‘bearish evening star’ set ups.

The Russell 2000 is just a shade above its 200-day MA, and probably a day away from the first Fib retracement.

The Nasdaq looks better prepared to retest 4,601 breakout support. Watch for a bearish ‘sell’ trigger in the MACD.

The S&P is looking at a test of the 20-day MA, but like the Nasdaq, next major support is not until the breakout level at 2,009.

Even the semiconductor index couldn’t escape the selling. It finished with a bearish ‘evening star’ too, and is a couple of days worth of selling from a test of its 20-day MA, and a long way from a test of breakout support. It too is close to a MACD trigger ‘sell’, which is likely to govern the next consolidation.

Watch for some follow through on today’s selling. Shorts will need a retest of highs before picking their attack, so this decline isn’t likely to do more than shake some weak longs out of their positions.

Leave A Comment