When the Nasdaq is up 10 straight days – a little consolidation never hurt anyone.

While it is much more common to see the Nasdaq have these kinds of runs than the S&P 500, it still needs to cool off here. What’s amazing about the run is that it comes right after the Nasdaq was in the process of a breakdown on the charts and when money was pouring out of all things tech related.

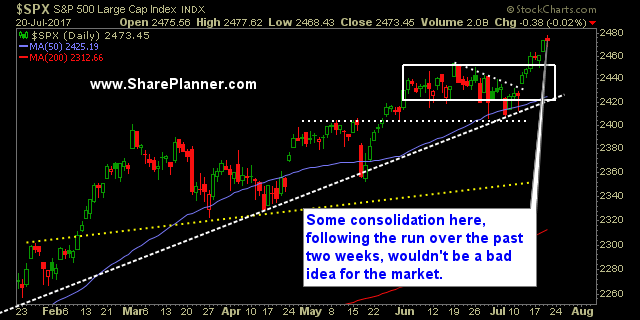

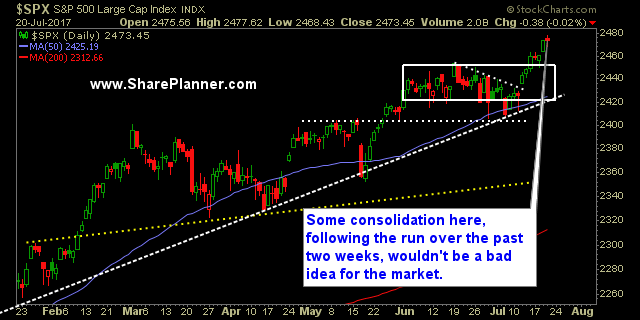

But once the machines were activated, well, nothing else mattered. The continued theme is that the market needs to start breaking down in order for the market to rally hard to the upside. It can be frustrating for traders, I for one, on the third of July, thought SPX might finally be rolling over – it was exciting really. But the ensuing action is the very reason why I never got heavily short on it – because you have this ‘go-gangbusters’ mentality every time there is a dip.

That will all come to an end someday – it always does. But for now we are left with a market that you can’t really short with any real aggressiveness, and at the current, all-time highs that the market across the board are trading at, it would do well for some consolidation in order to digest the recent gains. I expect to see more of that today and in the days ahead.

I have been quiet in my trading the last couple of days, simply because the market has reached such inflated levels, that the trade setups that I do find, aren’t worth taking and the risk/reward is grossly skewed against me at this point if initiating new trades to the long side. Take care of your own trading, keep raising the stops, and simply be patient as you wait for more and better trade setups to present themselves to you.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance:

Recent Stock Trade Notables:

Leave A Comment