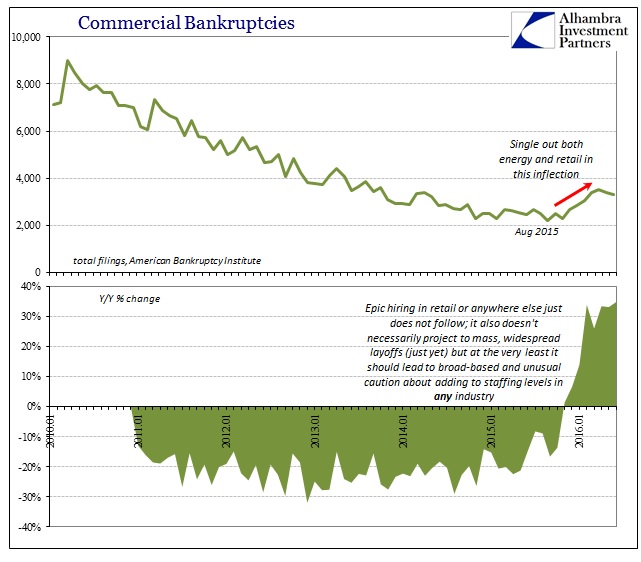

Last week, the American Bankruptcy Institute (ABI) released its updated statistics for commercial bankruptcies through June 2016. For yet another month, bankruptcies jumped by 30% over the same month in 2015. Total commercial filings were 3,294 in June, compared to 2,442 in June 2015; Chapter 11 filings were up 36% year-over-year. The turn in apparent liquidity and business struggles occurred at the end of last summer and into the autumn. Though the energy sector is prominent in the inflection, it is noteworthy that the ABI singles out one other particular industry:

“As economic challenges continue to weigh on the balance sheets of struggling companies, especially those in energy and retail, more businesses are seeking the financial fresh start of bankruptcy,” said ABI Executive Director Samuel J. Gerdano. “Commercial bankruptcy filings for 2016 will likely total close to 40,000.”

Announced job cuts in the retail sector at the beginning of the year seemed to confirm the growing distress. Though layoffs have come down over the past few months, there remains a divergence between what these figures suggest and the BLS employment numbers for the industry. According the payroll statistics, employment in the retail sector paused only for two months in April and May, with no net gains. Rather than signal a change in economic behavior, however, it was as likely a regular statistical variation; there was a similar 2-month pause recorded for last August and September.

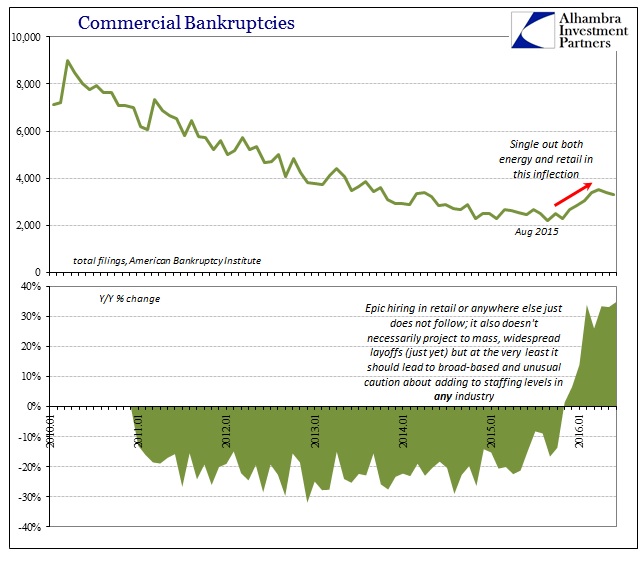

The pace of expansion is far out of line with what we find in so many other accounts – including retail and wholesale sales (and inventories on both levels). For an industry that might be struggling to the point of increased bankruptcies, the government figures that employment in the industry is unrelated to the possibility. For the most part, the BLS continues to suggest hiring without any serious break apart from the typical statistical variations.

Worse, this divergence dates back to the 2012 slowdown. Plotting BLS estimates for payrolls in the retail industry against the Commerce Department’s estimates for retail sales (ex autos), factoring a 7-month lag for employment levels to align with changes in topline sales, we find a large difference dating back to 2012 and early 2013. The economy in retail sales and throughout industry and manufacturing clearly slowed at that time, but somehow there was no break in the employment trend.

Leave A Comment