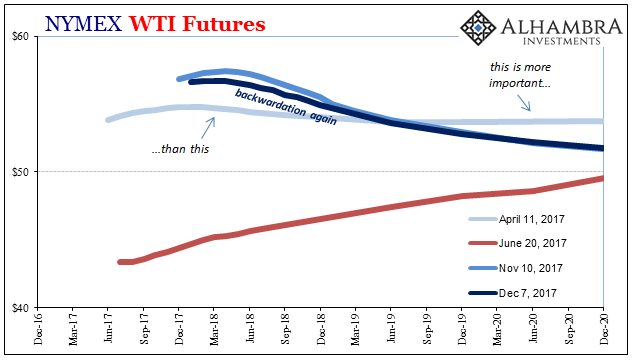

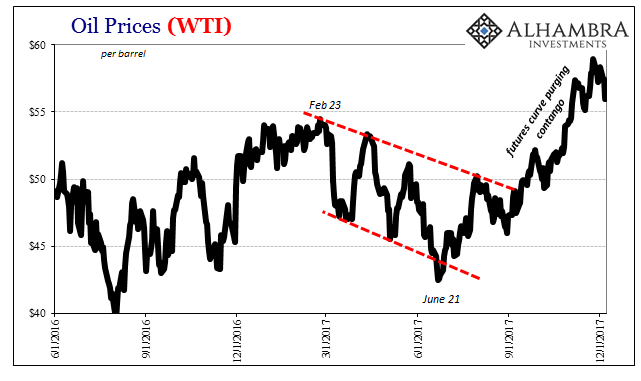

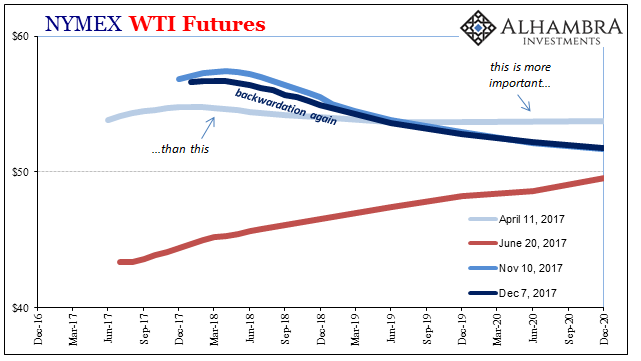

US domestic stocks of crude oil continue to be quite high and now the futures curve is only a few pennies in the front month contract from being fully backwardated again. Contango is gone, which suggests that oil market is in sight of achieving some measure of balance. That anticipated equilibrium, however, is registering at less than $57 rather than being anchored somewhere much, much higher in pricing.

Instead of geopolitical concerns pushing up the front end prices, including the spot price, maybe instead it was the futures curve moving back into its more normal downward sloping shape that pushed oil up. That could also be why the oil price run over the past few months did not register anywhere else, from TIPS and forward inflation rates to risk prices like leveraged loans that all were lower instead. Achieving oil balance here is a negative commentary on downward risks.

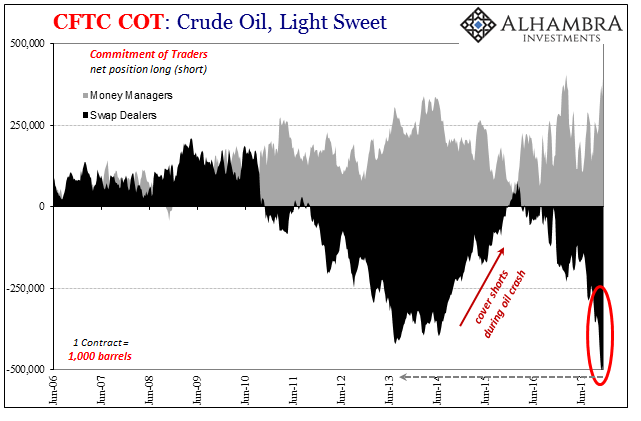

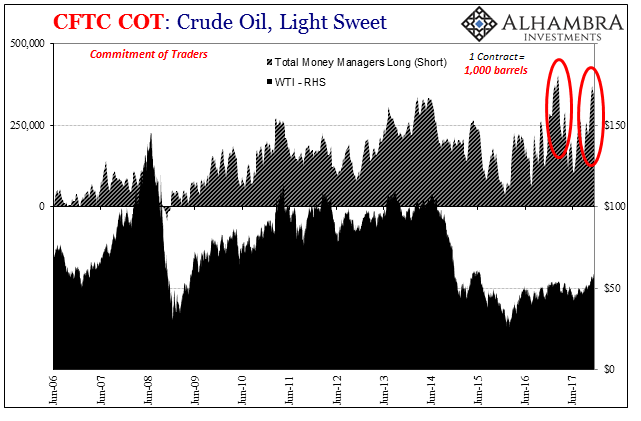

Maybe that’s what’s pushed Swap Dealers in the futures market to have simply lost their minds. After putting on a massive net short position up to a few weeks ago, a record number of contracts, that short has actually grown larger since. At -470k contracts (net) the first week in November, the CFTC’s Commitment of Traders (COT) for the week of November 28 (the latest available) registers an impressively dedicated -520k net short for dealers (it doesn’t even fit my chart below).

Not even Money Managers appear willing to offset that negative bet with their own enthusiasm on the long side. The net long position in this latter group is still high, but not quite matching the positive expectations from earlier this year. In terms of intensity to the opposite side, managers aren’t willing to chase their upward price convictions nearly as far as dealers have done in the opposite direction.

Normally, manager futures positions determine the price of WTI. This year has been a clear exception. In the last few months the swap dealers have been supremely active canceling out what might have been otherwise substantial buying momentum – leaving me to suspect that it was futures curve dynamics pushing up the front end prices.

Leave A Comment