In this week’s Commitments of Traders Report, notable changes in speculator positions in major currencies and commodities are fairly limited. The most substantial changes can be seen in the British pound and the Swiss franc. Speculators significantly increased their bets against the British pound, while reducing their bets against the Swiss franc this week.

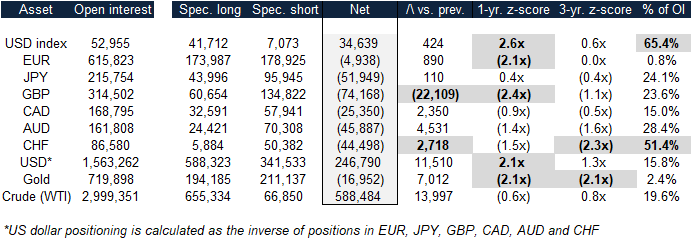

Looking at extremes in positioning, short British pound is once again at a bearish extreme this week. There are no other notable changes. Long US dollar, short euro, and short gold remain two standard deviations above 12-month trailing averages. Short gold and short Swiss franc positions are also at a bearish extreme based on 36-month trailing averages.

The purpose of this weekly report is to track how the speculator community is positioned across various major currencies and commodities. When net long positions become crowded in either direction, we flag extended positioning as a risk. Crowded positions do not suggest an imminent reversal, but should be considered as a significant risk factor when investing in the same direction as the crowd. This is shown below:

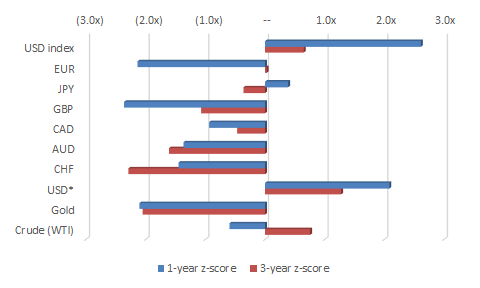

CFTC COT speculator positions (futures & options combined) – August 28, 2018

Source: CFTC, MarketsNow

Notable extremes, significant changes in weekly positions, and large net positions as a proportion of open interest are highlighted in gray above. Extremes in net positions are highlighted when speculator positioning is more than two standard deviations above trailing 1-year and 3-year averages. Weekly changes are highlighted when they are significant as a proportion of open interest. Finally, net positions as a proportion of outstanding interest are highlighted when they are large relative to historical averages. 1-year and 3-year z-scores are visually represented below:

1-year and 3-year z-scores based on net speculator positions

Source: CFTC, MarketsNow

Looking at recent trends in the British pound, speculators significantly increased their bets against the currency one day ahead of its biggest jump in seven months. Fears regarding a ‘no deal’ Brexit continue to plague the pound, despite some recent strength in forward-looking economic indicators. As we wrote on August 30, foreign exchange traders bought the pound following chief EU negotiator Michel Barnier’s comments. Beyond a big jump in the price, the recent move was also accompanied by significant trading volumes. This is a bullish sign that shows traders are buying with conviction (at least in the short-term). However, the long term trend remains bearish. Later in the week, the pound ran out of steam towards the top-end of its indicated daily trading range (1.3040). GBP/USD last traded at 1.2956 on August 31.

Leave A Comment