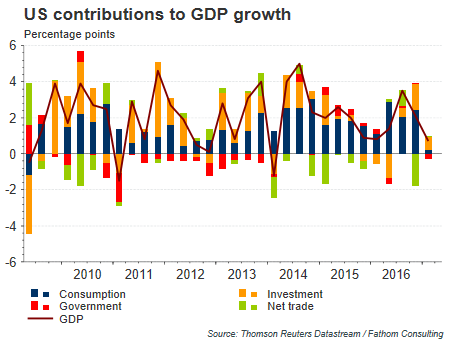

The first reading for Q1 2017 GDP came in at a weak .7% at an annualized rate. A particularly weak component of the report was consumer spending which rose only .3% and is the weakest level for spending since the fourth quarter of 2009. The blue portion of the bars in the below chart represent the consumer contribution to GDP and the weak report in Q1 2017 is evident.

Over the past few years, first quarter GDP numbers have been weak for a number of reason. However, many believe there are issues with the government’s seasonal adjustment factor. Nonetheless, is there something else impacting the consumer which could indicate potential headwinds lie ahead for the economy and is being reflected in recent credit card data?

This past week, several financial firms reported earnings, Synchrony Financial (SYF), Capital One Financial (COF) and Discover Financial Services (DFS) and each company has a sizable portion of their business in consumer credit cards. Earnings for both SYF and COF were anything but positive relative to expectations. DFS earnings were not too weak and the company reported only a small earnings miss. Below are some comments from the company conference calls and/or earnings press releases.

Capital One Financial:

Net income fell 22% to $752 million while its earnings per share of $1.54 came in 39 cents below the average estimates of analysts. The company increased its loan loss provision by 30% year over year to $1.9 billion, as the 30-day plus delinquency rate climbed 28 basis points, to 2.92%. Meanwhile, net charge-offs rose 28% to $1.5 billion and its rate of net charge-offs to total loans increased 42 basis points to 2.5%. Most of the delinquencies and charge-offs were in the bank’s credit card and auto loan portfolios (emphasis added).

Synchrony Financial:

First quarter net earnings totaled $499 million or 61 cents per diluted share versus average analysts’ estimates of 73 cents. Our results were impacted by the 45% increase in the provision for loan losses we experienced this quarter. The reserve build from the fourth quarter equalled $322 million. The reserve builds for the next couple of quarters are likely to be in a similar range on a dollar basis to what we saw this quarter. While most of the build continues to be driven by growth and the normalization we are seeing in the portfolio, lower recovery pricing in the quarter also drove approximately $50 million of additional reserves or 7 basis points of coverage. The net charge-off rate was 5.33% compared to 4.74% last year. we now expect NCOs to be in the 5% to low-5% range this year (emphasis added.)

Leave A Comment