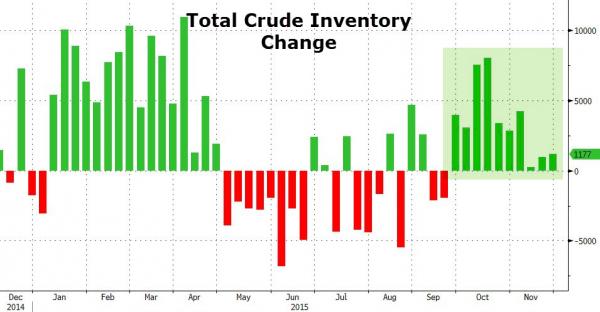

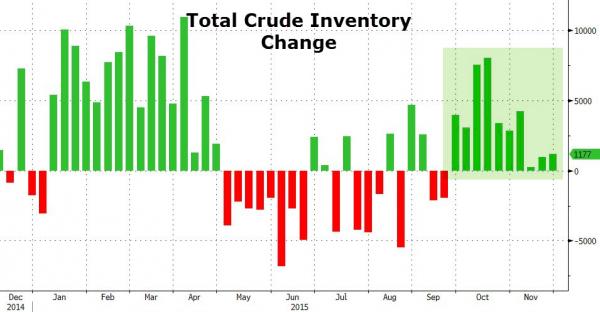

Confirming last night’s API report, DOE reports that total crude inventories rose for the 10th week in a row (up by 1.177mm barrels). This is a huge surprise relative to the 800k draw that analysts expected as total product demand dropped 1.6% relative to last year. Which all makes panicked cash-flow sense as production rose by 37k bpd.

10th weekly build in a row…

Production rises to highest since Aug 28th…

Which is happening as demand tumbles…

And the reaction…

Charts: Bloomberg

Leave A Comment