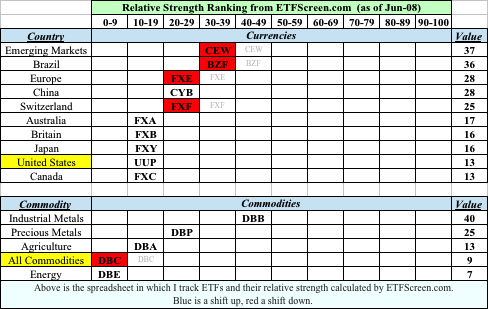

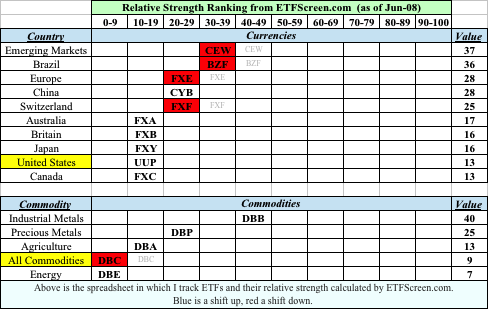

What is this spreadsheet telling us?

For one, both currencies and commodities are weak relative to stocks which is obviously bullish for stocks.

Also, the US Dollar is relatively weak compared to the Euro and the Emerging Market currencies, and that is bullish for foreign stocks.

All of the commodities are weak, including gold. It means avoid commodity producing stocks… although (gulp) I did go long the gold miners based on this week’s bullish breakout. It appears I have broken my own trading rule.

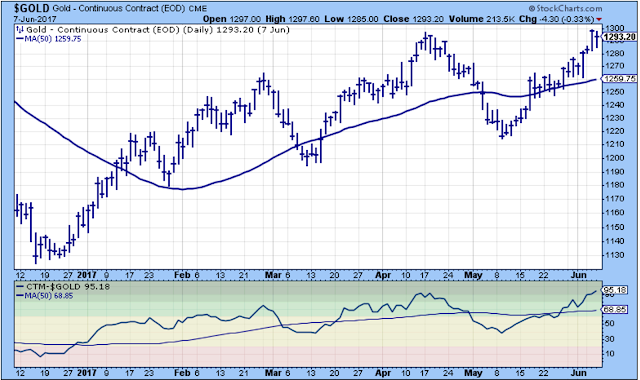

We will probably know soon if this is a break out. This weekly chart below makes it look like gold is just touching the downtrend and hasn’t broken out.

The daily chart is a lot more encouraging than the weekly. This is a series of higher highs and higher lows, although the most recent price is stuck at resistance.

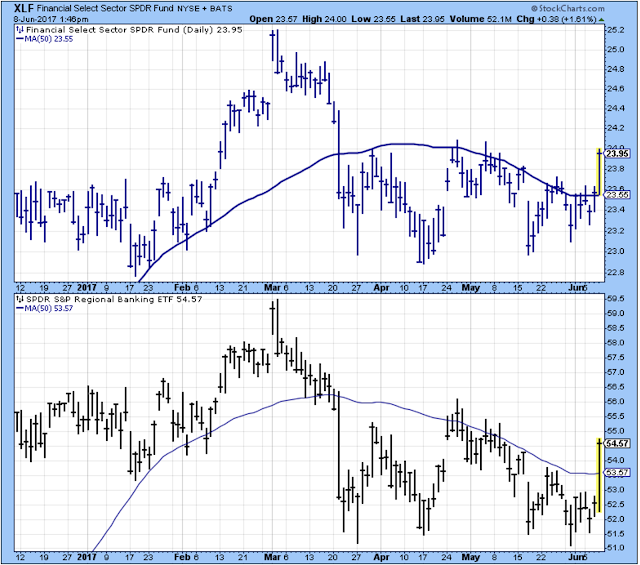

A big day for Financials.

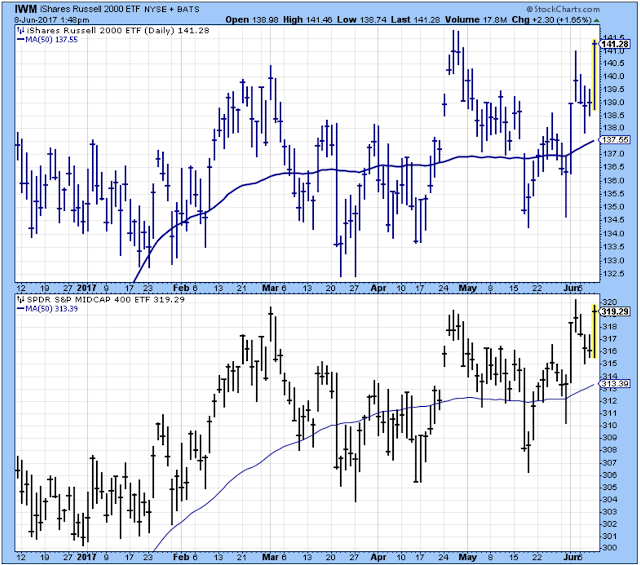

Not a bad day for small companies either.

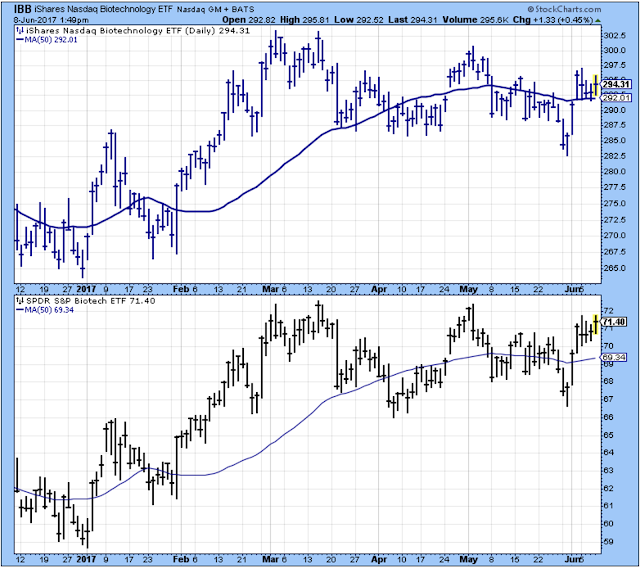

Biotech looks interesting as it pushes up against the top of the range.

Outlook

The long-term outlook is positive.

The medium-term trend is up..

The short-term trend is up as May-24.

Leave A Comment