This week the Bureau of Economic Analysis will release updated estimates for Q2 GDP as well as Personal Consumption Expenditures (PCE) and Personal Incomes for July. Accompanying those latter two accounts is the currently preferred inflation standard for the US economy. The PCE Deflator finally hit 2% and in two consecutive months, after revisions, earlier this year.

The inability of consumer prices to maintain that pace is actually related to continuing weakness in the rest of the PCE reports, and therefore spilling out into GDP. Each of these numbers is often individually described as “strong” or “robust”, but together they demonstrate instead quite the opposite condition. If they were actually strong and robust economists would not have become so interested in drug addiction.

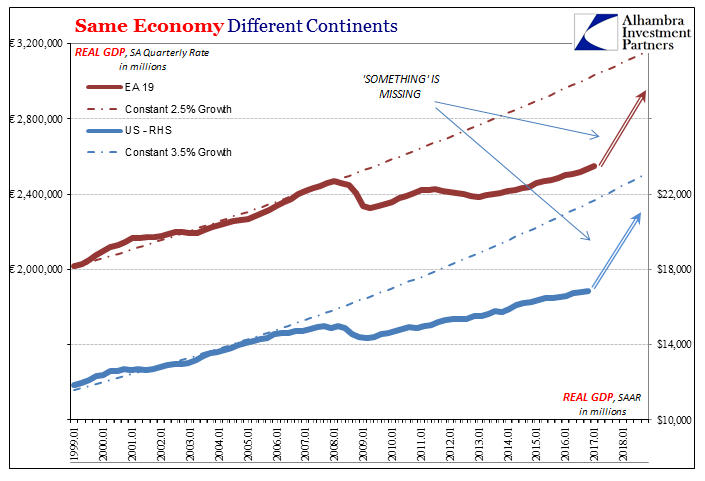

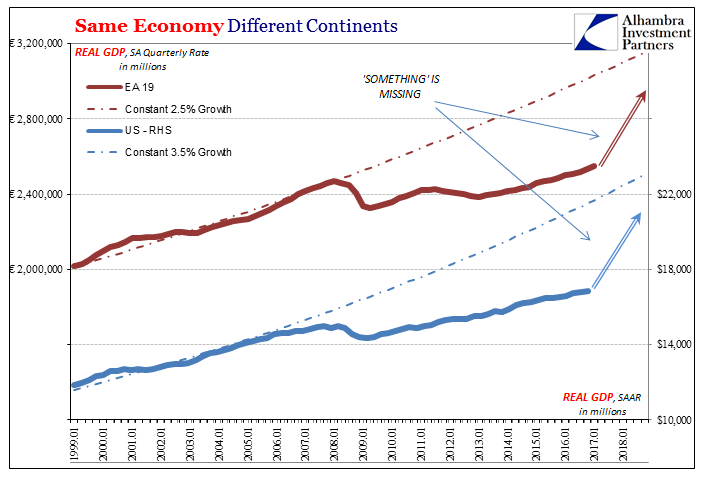

What confounds most people is the time component. It doesn’t seem possible that an economy could out of the blue just stop growing, and then remain that way. For ten years Americans have been waiting for recovery from the last “recession”, and for ten years they have been disappointed. It has created this growing rift, institutional mistrust where in the mainstream (however that may be defined) things are always good and yet for too many at the too thick margins of the economy there is no semblance of opportunity.

To the latter, time has been definitive; it’s not coming and never will. For the former, that possibility is just now being recognized, only it has to overcome vast confirmation bias. There is nothing in our history except the Great Depression that suggests ten years (or more) of no growth. Therefore, many people have convinced themselves (economists, policymakers, the media) that it just can’t be possible, or that its end just has to be right over the horizon.

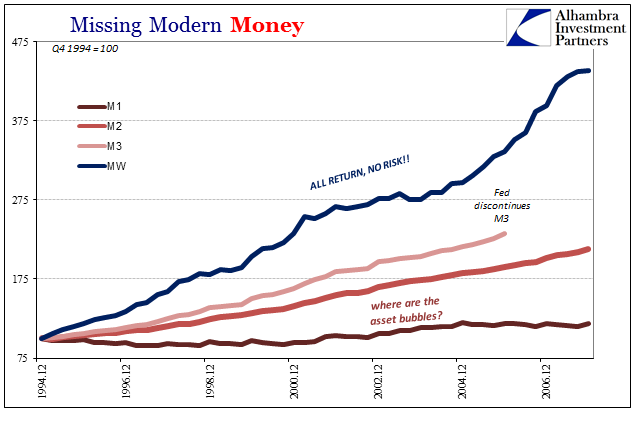

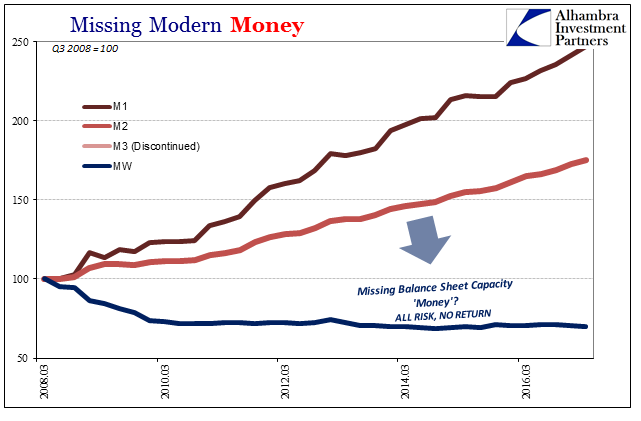

This error typically has its roots in money. The Fed did QE and QE is always described as money printing, therefore money cannot be the issue. No one ever challenges the right of whoever is rote reciting the formula to show their work. QE is money printing because QE is money printing; trying to rationalize to a self-imposed tautology is not a recipe for success in any discipline.

Yet, we know intuitively that whatever might be wrong started to be wrong ten years ago during an unambiguous monetary event. Even if you think QE is money, the primary output of money through finance hasn’t been the same since that time.

Leave A Comment