It may sound quaint today, but there was once a time when high-speed internet was not ubiquitous, and for many Americans, the only place to find a high-speed internet connection was at work. Due to the lack of high-speed internet access, Americans would head back to work after a long holiday weekend and start shopping. Hence, the term “Cyber Monday” entered the lexicon. Today, high-speed internet access is everywhere, so Cyber-Monday has become a bit of a relic, but don’t tell that to online retailers who will use any and all excuses to give consumers the impression that they are getting a bargain (Prime Day, anyone?).

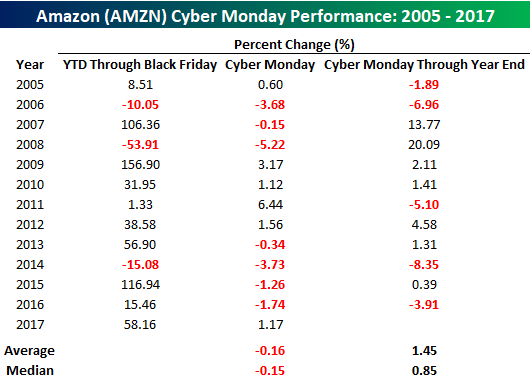

With all the attention still focused on Cyber-Monday by retailers, we wondered if it had any impact on the performance of online stocks like Amazon.com (AMZN).To that end, the table below lists the performance of AMZN’s stock on and after Cyber-Monday going back to 2005, which is when its Prime Service was first introduced. As shown in the table, Cyber-Monday has hardly been a catalyst for gains in AMZN’s stock price. Since 2005, the stock has seen an average decline of 0.16% on Cyber-Monday with gains in only six out of thirteen years. Furthermore, this year’s gain of 1.17% breaks a streak of four straight years where the stock was down on Cyber-Monday. In the period from Cyber-Monday through year-end, shares of AMZN have performed better on a historical basis. However, with an average gain of just 1.45% during a period where the overall market sees strength as well, the holiday shopping season hasn’t been particularly strong for AMZN.

So, if Cyber-Monday hasn’t been particularly strong for AMZN, what about the traditional retailers? In this case, performance is even worse. The table below shows the historical performance of the S&P Retail ETF (XRT) on and after Cyber-Monday since 2007 (historical data for the ETF doesn’t go back any further). In this case, the performance of retail stocks on Cyber Monday has been lousy. To highlight, if today’s modest gains in the ETF hold, it will be just the second time since 2007 that XRT has traded in the black on Cyber Monday. Overall, the ETF’s performance has been an average decline of 1.64% (median: -1.17%). For the remainder of the year, XRT has tended to recover a bit, but with an average gain of 0.89% (median: +0.70%), the group still underperforms the broader market during this period.

Leave A Comment