Who could have seen this coming?

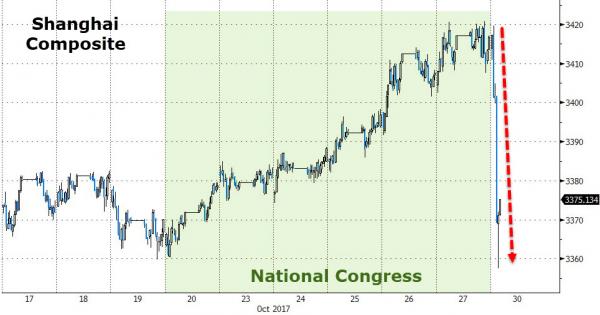

After weeks of ‘calm’ – demanded by The People’s Party – and well-managed ‘National Team’ ramps top ‘prove’ how much Xi’s plan for the next five years is being received, the end of China’s National Congress has been met with… a plunge in stock and bond markets.

This is the biggest drop in the Chinese market in 11 weeks…

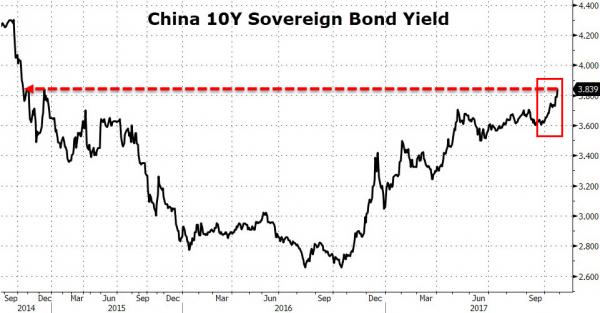

But it’s not just stocks. The Chinese bond market is getting slammed…

China 10Y yield is up 6 days in a row (the biggest surge in rates since May) to their highest since Oct 2014…

With the Chinese yield curve now inverted for 10 straight days – the longest period of inversion ever…

As Bloomberg reports, the situation that’s existed for most of 2017 – sovereign yields rising, and corporate debt remaining relatively resilient – is at risk of cracking. As appetite for bonds of any kind dwindles and authorities roll out measures that target higher-risk investments, company securities are in the line of fire.

Now that the Communist Party Congress is over, China’s bond holders may be about to get hit by “daggers falling from the sky,” said Huachuang Securities Co., referring to aggressive deleveraging policies.

“It’s very likely we will see a significant increase in corporate yields in the coming year,” said David Qu, a market economist at Australia & New Zealand Banking Group Ltd. in Shanghai.

“The trigger could be tougher regulations or a default. A majority of non-bank financial institutions’ debt holdings are corporate bonds, so their selloff can lead to severe consequences. Banks are underestimating authorities’ intentions to tighten regulations.”

“The deleveraging campaign hasn’t even gone half way, and the risk of banks redeeming entrusted funds could surface at the end of this year,” said Qin Han, chief bond analyst at Guotai Junan Securities Co. in Shanghai.

“The chance of a selloff in corporate bonds is increasing, which will result in a widening of their yield premium over sovereign notes.”

Leave A Comment