Market headlines

Today’s Economic events

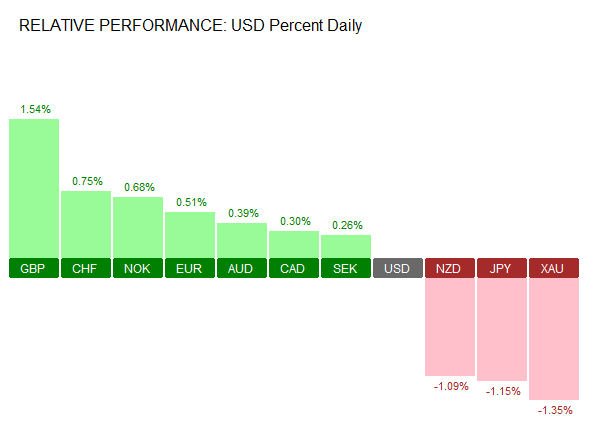

Market Performance

FX Market Performance (12GMT, 14/07/2016)

Australia unemployment rate rises to 5.80%

Latest data from the Australian Bureau of Statistics showed that the unemployment rate rose to a seasonally adjusted 5.80% in June. The Australian unemployment rate was at 5.70% previously in May. On the month, the economy was seen adding 7,900 jobs lower than the forecasted 10k job estimate. The slower pace of job numbers follows May’s net job gains of 19,200.

Australia Unemployment Rate – July 2016 (5.80%)

Full-time employment hiring saw an increase of 38,400, while part-time jobs fell 30,600 during the month of June. The participation rate edged higher to 64.9% from 64.8%.

Commenting on the jobs report, ABS analysts said “the figures show that hours worked by employed people declined, but not by as much as in previous months. We are yet to see an increase in hours worked in 2016.”

Still, many believe that Australia’s unemployment report as understated. The ABS also acknowledged this in a note saying, “We were expecting a soft headline number today because the group being ‘rotated out’ had a much higher employment to population ratio than then the average of the sample. That is, the odds lay with the incoming group having a lower employment to population ratio than the group going out.”

Leave A Comment