The S&P 500 (Index: INX) saw some major intraday swings during the first week of May 2018, with the combination of Thursday, 3 May 2018 and Friday 4 May 2018 combining to take the index on the wildest ride of the week.

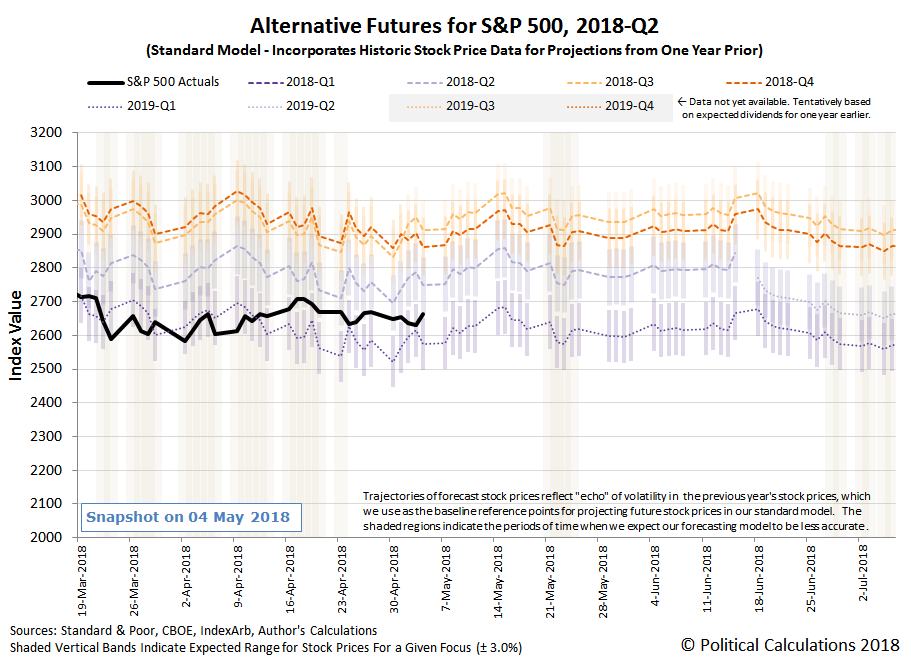

Tracking each day’s closing value of the S&P 500, what we find is that the level of the S&P 500 is consistent with investors continuing to split their attention between the current quarter of 2018-Q2 and the more distant future quarter of 2019-Q1, although slightly favoring the current quarter during Week 1 of May 2018.

That makes a lot of sense in the context of the news of the past week, where we’re nearing the end of earnings reporting season taking place during 2018-Q2, so investors are continuing to keep a good portion of their forward-looking attention on the current quarter. Here are the market-moving headlines from the week that was…

Monday, 30 April 2018

Tuesday, 1 May 2018

Wednesday, 2 May 2018

- Key sticking points in the U.S.-China trade dispute

Thursday, 3 May 2018

- Boom in West Texas oil patch lifts wages, prices

- China to suspend checks on U.S. scrap metal shipments, halting imports

- U.S. asks China to reduce trade imbalance immediately: WSJ reporter on Twitter

- China offers to increase U.S. imports, cut tariffs on some products: sources

- U.S., China commit to solve trade dispute through dialogue: Xinhua

Leave A Comment