Investing themes can come and go. From mid 2014 to mid 2015, the cyber security industry was the “hot buy.” Some cyber stock prices soared anywhere from 80% to nearly 300% in this time span. Ultimately, the buzz wore off and valuations sank to lower levels. With the White House making headlines about advanced cyber security spending, this sector is back in momentum traders’ crosshairs. This week’s Danger Zone pick is up 22% this year while the S&P is up just 5%. However, the fundamentals of the business make it hard to imagine a scenario where this firm can meet the expectations baked into its lofty valuation. For these reasons and more, Palo Alto Networks (PANW : $155/share) is in the Danger Zone.

Revenue Growth Without The Profits To Show

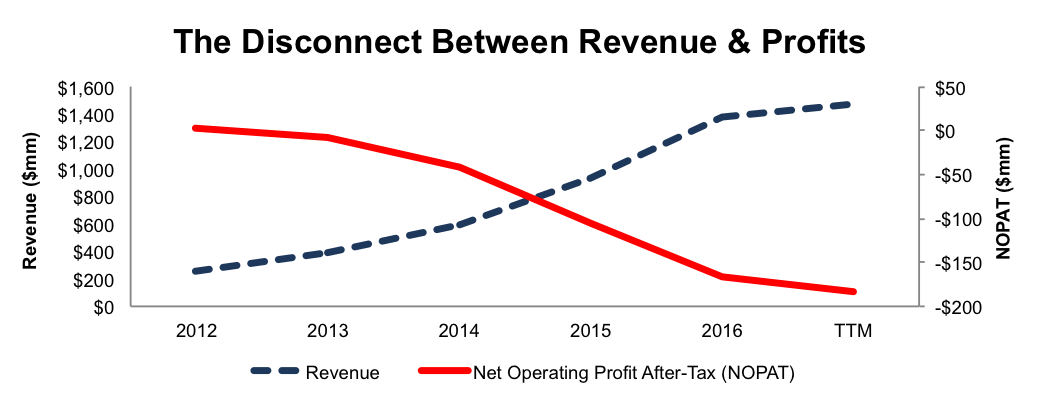

Palo Alto Network’s after-tax profit (NOPAT) declined from $2 million in 2012 to -$165 million in 2016. NOPAT has fallen to -$184 million over the last twelve months (TTM). This decline in profit comes despite revenue growing 52% compounded annually from 2012-2016, per Figure 1.

Figure 1: PANW’s Profits Fall Despite Soaring Revenue

Sources: New Constructs, LLC and company filings

The issues with PANW’s business run deeper than just NOPAT. The company’s return on invested capital (ROIC) is currently a bottom-quintile -25%. Additionally, the firm has burned through a cumulative $1 billion (7% of market cap) in free cash flow over the past four years. Palo Alto’s business is faltering across many different key metrics.

Compensation Plan Misaligns Executive Interests

Palo Alto’s executive compensation plan misaligns executive interests with those of shareholders and fuels the profit losses shown above. In fact, the current compensation plan allows executives to earn large bonuses while shareholder value is destroyed.

PANW executives are eligible for base salaries, cash bonuses, and long-term equity awards. The cash bonuses are tied to the achievement of revenue and EPS goals. Management believes “revenue is a key metric during this stage of our growth and enhances long-term value creation for our stockholders.” As shown in Figure 1, revenue growth has done little to enhance the profitability of the firm.

For 2017, a performance threshold was added to Palo Alto’s long-term equity awards. The performance portion of equity awards will now be paid out based on “billings.” “Billings” represent a non-GAAP measure for revenue and further misalign executive interests with those of shareholders.

As we’ve demonstrated before, ROIC, not revenue, EPS, or “billings”, is the primary driver of shareholder value creation. Without major changes to this compensation plan (e.g. emphasizing ROIC) investors should expect further value destruction.

Non-GAAP Metrics Create Illusion of Profitability

Non-GAAP metrics often mask the true economics of a business and create the illusion of profits. Palo Alto Networks uses non-GAAP metrics such as non-GAAP net income and “billings” to “provide investors an additional tool to evaluate ongoing operating results.” However, these metrics simply make the firm look profitable when it is, in fact, losing money. Below are some of the items PANW removes to calculate its non-GAAP net income:

These adjustments have a significant impact on the disparity between GAAP net income, non-GAAP net income, and economic earnings. In 2016 and 2015, PANW removed over $408 million (30% of revenue) and $233 million (25% of revenue) respectively in charges related to share-based compensation to calculate non-GAAP net income. When added to the other adjustments, Palo Alto reported 2016 non-GAAP net income of $153 million. Per Figure 2, GAAP net income was -$226 and economic earnings were -$216 in 2016.

Leave A Comment