From non-GAAP accounting to costly acquisitions, it is not difficult for a company to create the illusion of profits. However, eventually reality sets in and the deterioration of a business comes to light. This week’s Danger Zone pick, Textron Inc. (TXT: $42/share), is destroying shareholder value while covering it up with an acquisition that creates the illusion of profits via GAAP net income growth. The momentum behind this stock will reverse when investors realize this acquisition is not delivering and the business has been in a long-term decline.

GAAP Income Doesn’t Tell The True Story

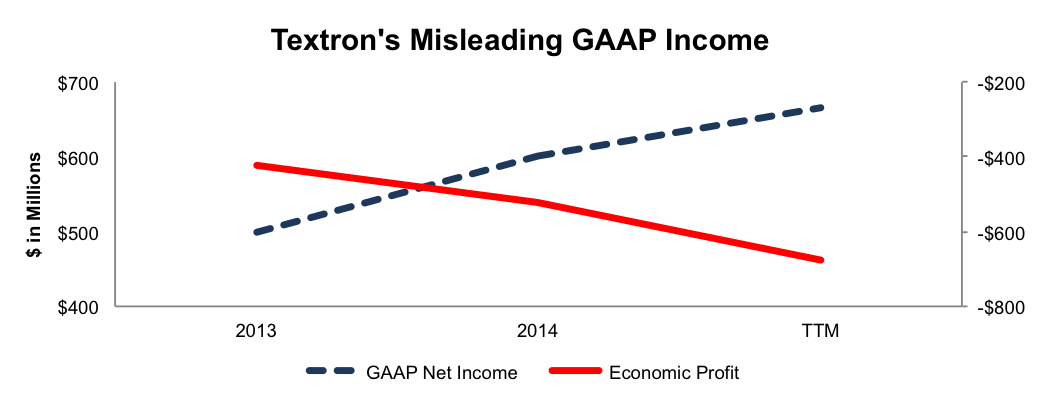

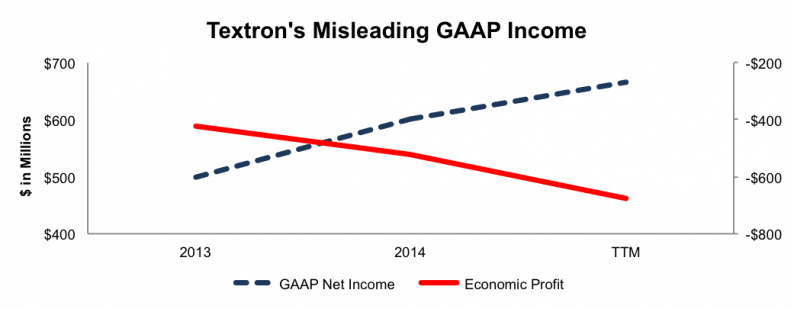

From 2013 to the trailing-twelve-months (TTM), Textron’s GAAP net income has grown from $498 million to $666 million. Over the same timeframe, the company’s economic earnings, or true earnings available to equity shareholders, have declined from -$422 million to -$677 million. This discrepancy can be seen in Figure 1.

Figure 1: GAAP Net Income Illusion

Sources: New Constructs, LLC and company filings

Unfortunately for investors, Textron has failed to earn positive economic earnings in any year in our model, which dates back to 1998. Through the use of accounting loopholes and the shortcomings of GAAP, Textron has been able to present itself as a profitable business despite destroying value the entire way.

The problem with using GAAP net income is that it overlooks almost the entire balance sheet. In 2014, the cost of capital that Textron needs to run its business totaled $1.2 billion, or $4.29/share. After removing this cost from reported earnings we see that Textron’s economic EPS were -$1.87 compared to GAAP EPS of $2.13 for 2014.

What investors need to realize is that, despite what GAAP numbers are showing, Textron’s numerous business lines have not been able to recover from the economic crisis in 2008. In that year, Textron earned a return on invested capital (ROIC) of 8%, which has since fallen to a bottom quintile 4% in the TTM. Additionally, Textron’s 7% NOPAT margin in 2008 has fallen to 4% over the TTM. With misleading earnings and a deteriorating business, it’s clear to see why Textron finds itself on November’s Most Dangerous Stocks list.

Textron’s Profitability Lags Competitors

Figure 2 shows that Textron’s 4% ROIC is much lower than that of its numerous competitors. Because Textron operates as an industrial conglomerate making airplanes, helicopters, golf carts, and automobile parts, it faces competition from a multitude of industries. However many of these competitors operate much more profitably that Textron. This lack of profitability creates a competitive disadvantage, especially when it comes to the stiff pricing competition the company faces.

Leave A Comment