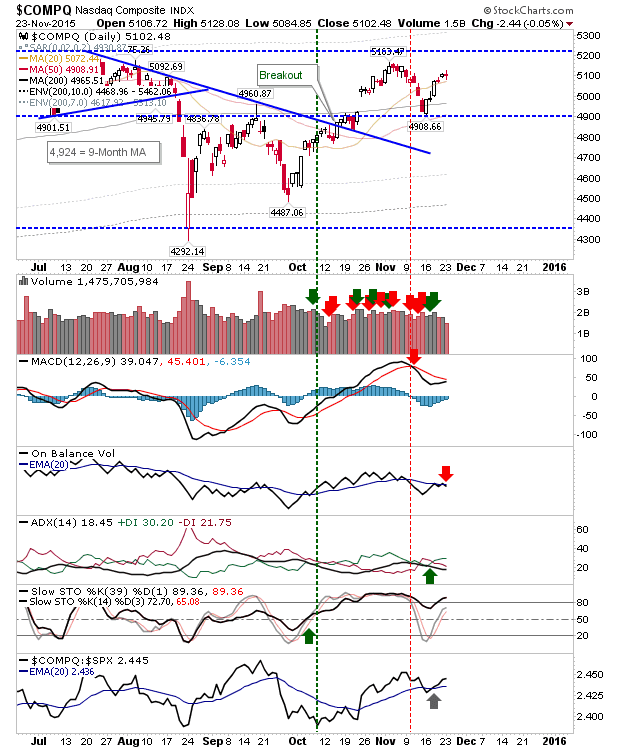

Modest losses on the day, but bears were unable to press declines. Volume was down considerably, which given the week that’s in it is not surprising. The Nasdaq finished with a ‘sell’ trigger in On-Balance-Volume.

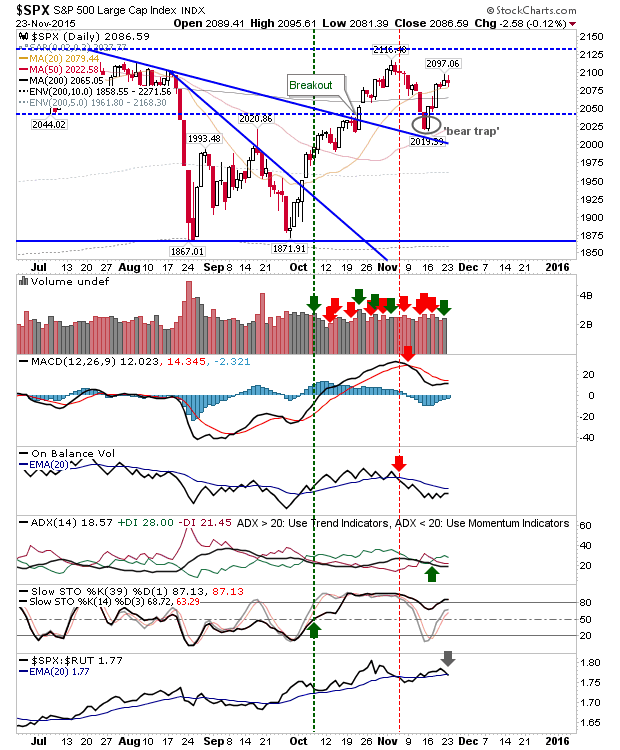

The S&P closed with a spinning top, but didn’t lose its 20-day MA. There was a relative loss against the Russell 2000, which given the latter’s action over the last couple of months is really more bullish for the broader rally.

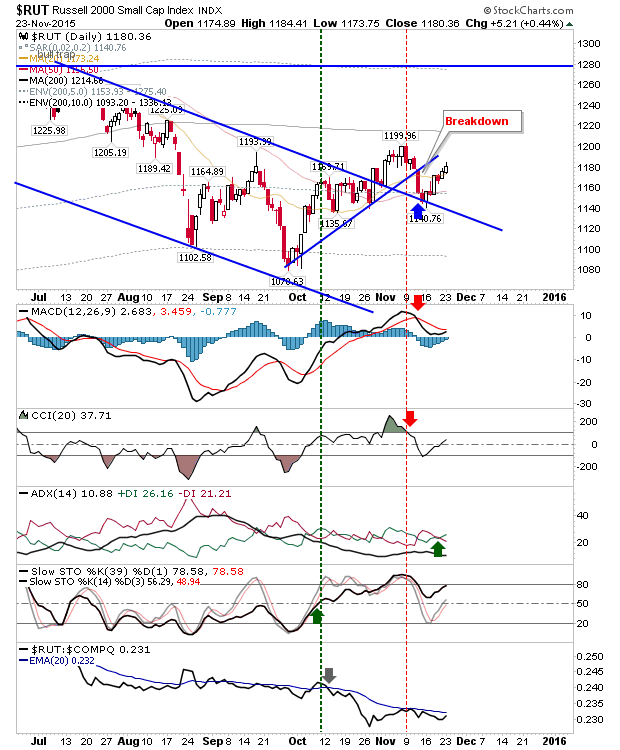

The reason for the relative change in the S&P to the Russell 2000 was the end-of-day gain in the Russell 2000. A move above 1,199 is needed to comfort bulls but today’s action will have helped towards this goal.

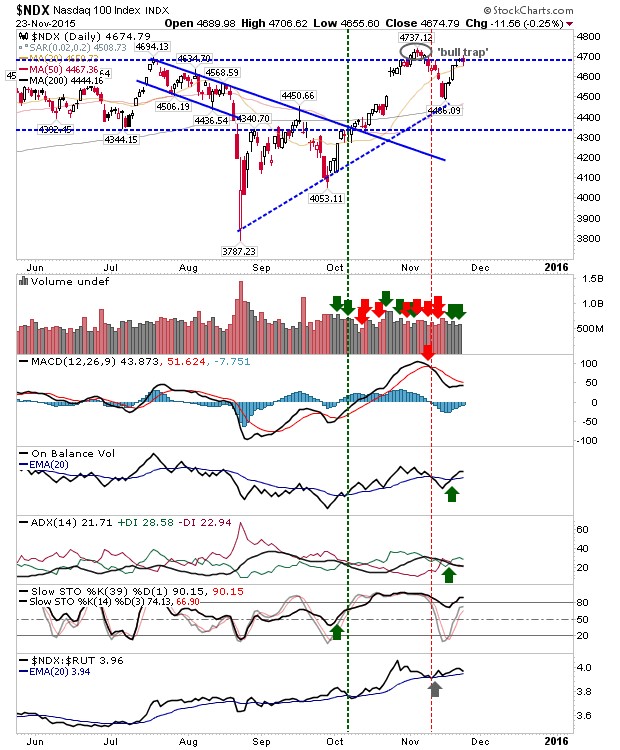

The Nasdaq 100 finished with a doji, just shy of negating the ‘bull trap’. Still waiting for the MACD trigger ‘buy’, which will either lead the breakout, or happen because of it. Shorts will need to be nimble.

For tomorrow, things will likely remain quiet as Thanksgiving approaches. Don’t be surprised if there is a low volume breakout in the Nasdaq 100. It would be the kind of action not unusual for a Black Friday.

Leave A Comment