The DAX 30 (CFD: GER30) was higher by 1.19% at the time of writing. The Telecommunications sector was the winner and up by +2.10% on the day, while the Utilities sectors was weakest, up by +0.22%.

Given the rapid rise that the DAX 30 experienced following Friday’s reversal (on the heels of a lower than expected NFP outcome ), it appears that a short-squeeze is underway as bearish traders in panic head for the exit.

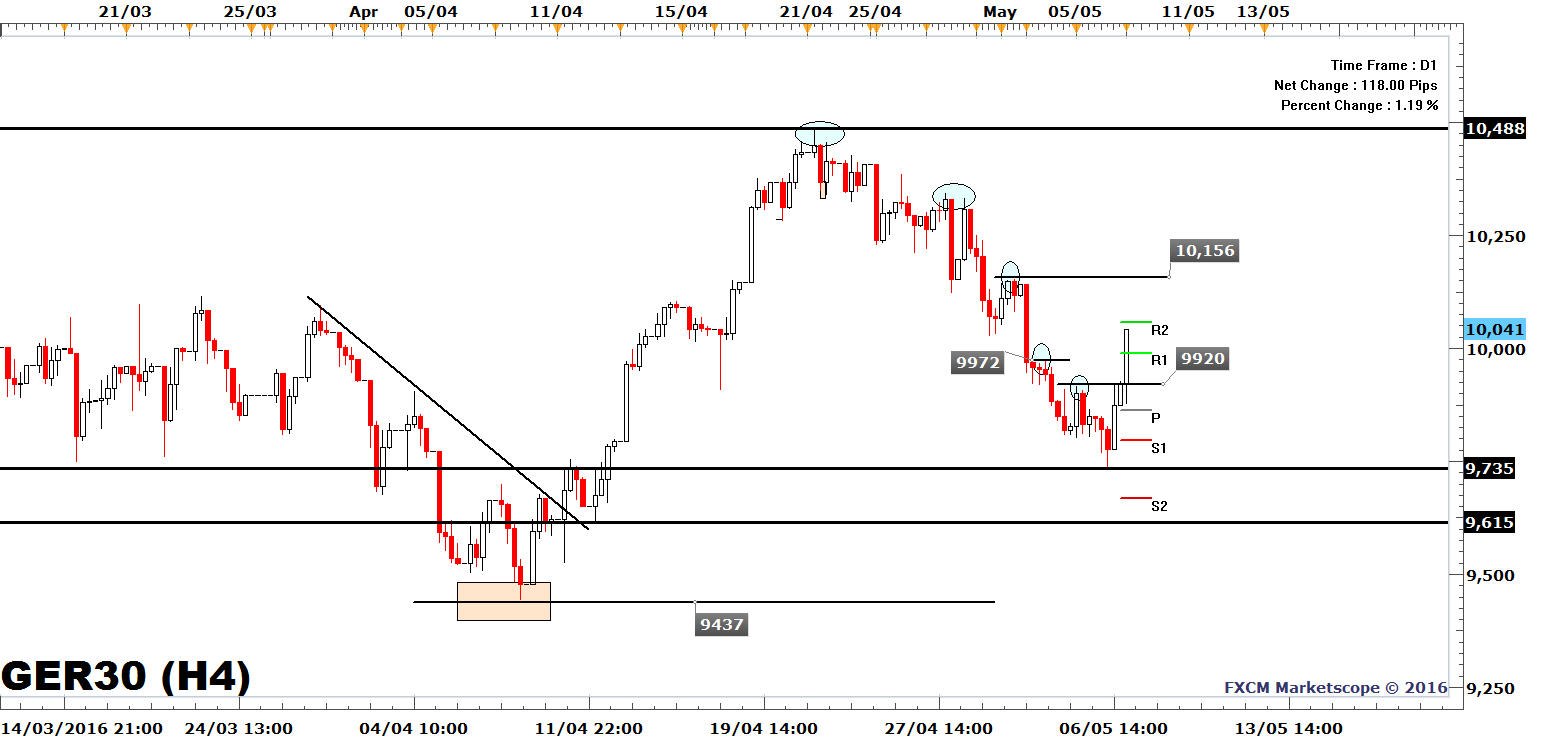

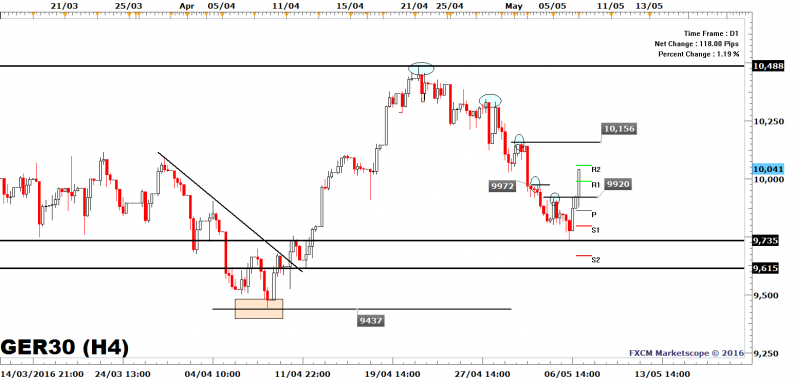

Price has now breached Thursday’s high of 9920 and the intraday high of 9972, formed in the afternoon of April 3. This has ended the short-term bearish trend in place since April 21 when the DAX reached a high of 10,488.

The bounce on Friday occurred from the 9735 level, which is a higher low in relation to the April low of 9437, and thereby left the bullish trend since February intact. The major lows of this bullish trend are 8705, 9123, 9404, and 9437. It is not clear if last week’s low of 9735 will hold, but with the short-term trend not being bearish any longer, the likelihood of the low holding has increased.

The next short-term resistance level is the R2 level of the Pivot Point indicator at 10,060 and followed by the April 2 high of 10,156. A strong support level for the short-term trend is last week’s low of 9735 while this morning’s low of 9878 is a less strong support level.

DAX 30 | CFD: GER30

Leave A Comment