If you dabble in the closed-end fund market long enough, you are probably going to own a fund that sees its dividend cut. This seemingly innocuous event can have numerous ripple effects for shareholders that should be carefully evaluated before you respond with any knee-jerk reactions.

Closed-end funds generally operate their dividend schedules in two ways: 1) a managed distribution schedule set by the board of directors or 2) an income-only policy that distributes the actual dividends generated by the underlying portfolio. Both dividend strategies are subject to continual review and can change out of left field even when the market appears calm on the surface.

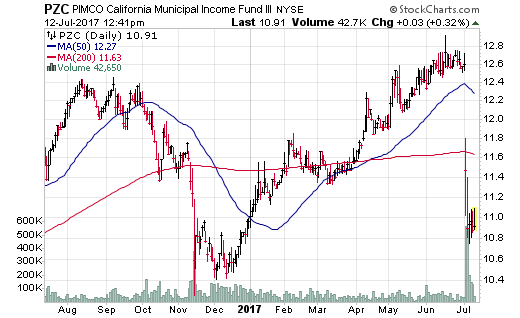

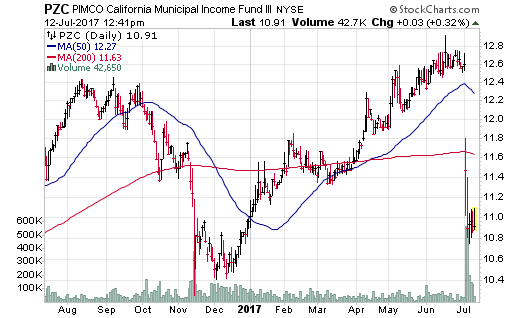

The most recent example is the PIMCO California Municipal Income Fund III (PZC), which announced a 25% decrease in its distribution rate beginning in August. PIMCO cut the dividend from a steady $0.06/share down to $0.045/share monthly. See if you can guess on the chart when this was announced.

The quick reaction by the market was a huge sell off on high volume as a result of the income cut. After all, CEF investors want yield and they want it now. This is particularly true for municipal bond holders that receive a lower front-end dividend stream in exchange for an attractive taxable-equivalent yield.

In the case of PZC, PIMCO is making a proactive change to balance the lack of available yield in the marketplace without compromising its asset management strategy. They likely don’t want to add duration or lower credit quality just to satisfy the short-term thirst for income that so many have become complacent with. They also don’t want to start returning capital within the dividend just to hit a yield bogey. It’s a good move over the long-term even if the current shareholders take a bit of a hit.

The reality is that you can’t feel all that bad for owners of PZC who experienced this drop. The fund was trading at approximately a 25% premium to net asset value when the announcement was made and is still clinging to an 11% premium at today’s prices. There were also warning signs when its sister fund, the PIMCO Municipal Income Fund (PMF) underwent a similar distribution cut in March.

Leave A Comment