Earlier this week, the bizarre, unexplainable, ongoing plunge in the dollar and US bond prices in the aftermath of the stronger than expected CPI print which also sent equities surging, prompted at least one trader at Citi to explode: “prompted at least one trader ”

Then again, maybe it is not all that unexplainable.

As Deutsche’s FX strategist, George Saravelos, writes, he has been getting numerous inquiries as to how can it be that US yields are rising sharply, yet the dollar is so weak at the same time?

He believes the answer is simple: the dollar is not going down despite higher yields but because of them. Higher yields mean lower bond prices and US bonds are lower because investors don’t want to buy them, or as he puts it “this is anentirely different regime to previous years.”

Below we repost his simple explanation, while highlighting that maybe…

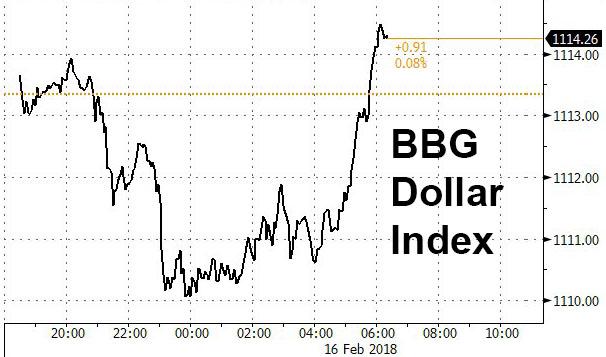

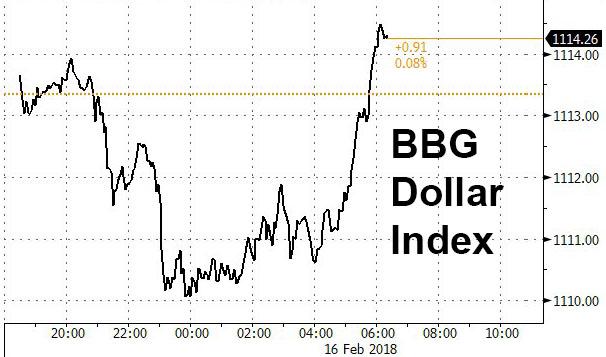

… just maybe, the bottom for the dollar is now in?

From Deutsche Bank:

Leave A Comment