Overheard everywhere today…

Stocks (Dow and S&P) hit record intraday highs… (must mean everything is awesome, right?)

With Nasdaq’s best week of 2017… So clearly, unlike The Leftists, Trump Jr’s email means absolutely nothing…

BUT…

This morning’s terrible retail sales and inflation data sent ‘hard’ data to new post-Trump lows – lowest since May 2015 – as ‘soft’ data clings to hope once again, sending ‘animal spirits’ back near record highs…

GDP expectations have plunged…

And then there is this… Short Interest in the S&P 500 has not been this low since May 2007, right as the market peaked…

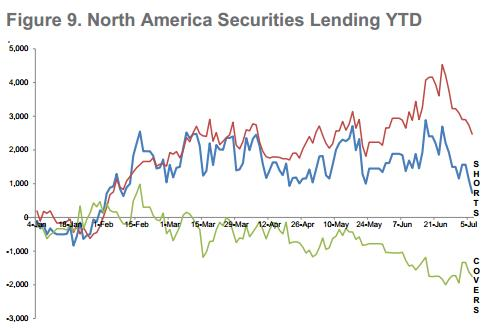

And as JPM Prime Broker Services shows, this week saw the largest amount of short-covering year-to-date…

* * *

Here’s today’s completely uniform, not at all odd, straight line, 100% correlated price action in stocks…

VIX chopped around into the close but it was a one-way street all day to get the S&P to intraday record highs (above 2453.82 on 6/19)…

FANG Stocks had their best week in 3 months… (up 5 of the last 6 days)

Despite all the exuberance over Bank earnings, financials lagged on the day (but as the green line shows, the dip-buyers were desperate) as Tech led…

JPMorgan was the biggest loser at the open, but you ‘buy the dip’ because it’s a no-brainer…

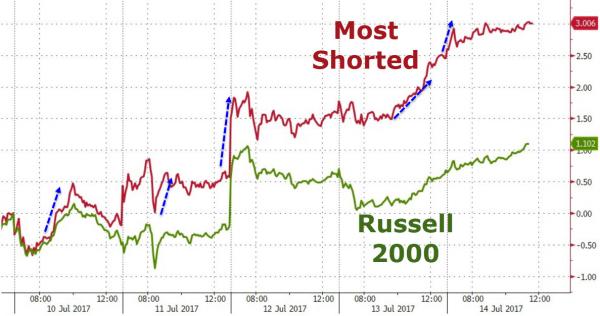

The “Most-Shorted” stocks are up 5 of the last 6 days – this week was the biggest ‘short squeeze’ since Dec 6th…

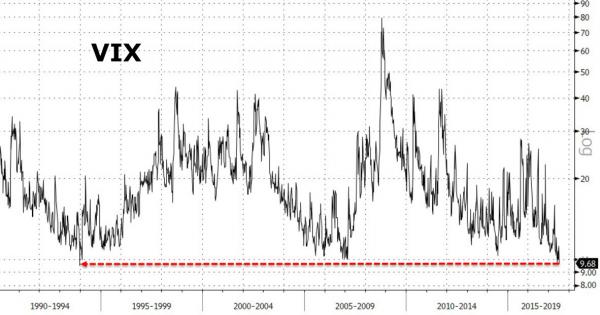

VIX was smashed lower again to its lowest weekly close since 1993… (9.48 close 12/24/93)

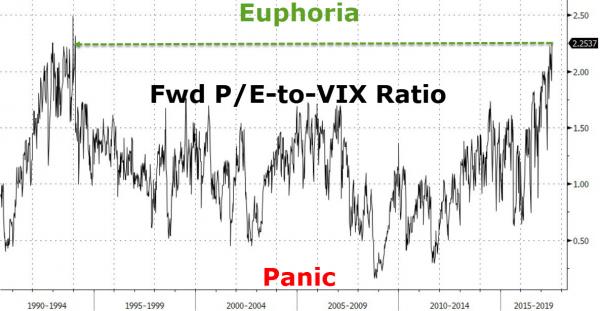

The stock market is near peak euphoria here (tracked by the ratio of Fwd P/E to VIX)…

Oh and Shiller’s P/E crossed above 30 (30.15).

While stocks gained on the week, so did Bonds (though the long-end underperformed)… (while 2s30s steepened for the 3rd week in a row, 2s10s flattened modestly on the week, after two big weeks of steepening)

Leave A Comment