Franklin Resources (BEN) manages the Franklin and Templeton families of mutual funds.The company was founded in 1947 in New York by Rupert H. Johnson, Sr., who previously ran a brokerage firm on Wall Street.

He named the company after founding father Benjamin Franklin, because Franklin epitomized the ideas of frugality and prudence when it came to saving and investing.

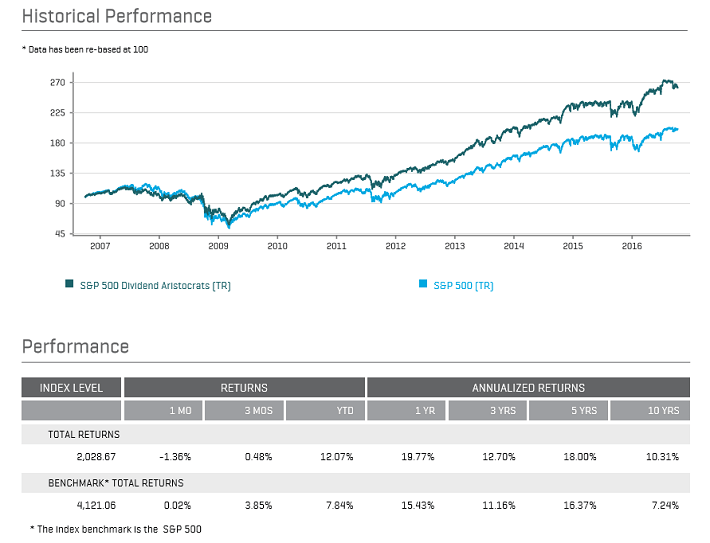

Franklin Resources has paid increasing dividends for 35 consecutive years.The company’s long dividend history makes it a member of the exclusive Dividend Aristocrats Index – which has historically outperformed the market.

Source: S&P Fact Sheet

This performance makes sense when you think about it…High quality businesses with the ability to pay rising dividends over time should perform better over multi-year stretches, all other things being equal.You can see a full list of all 50 Dividend Aristocrats here.

Franklin Resources is one of 5 Dividend Aristocrats in the Financial Sector.The company’s sustained success in a relatively volatile sector and industry speaks volumes about the prudence of the company’s management.

But…‘Past performance is no guarantee of future success’, as the well-told financial disclaimer goes.Will Franklin Resources sustain its long track record of growth?

Keep reading this article to learn more about the investment prospects of Franklin Resources.

Business Overview

Franklin Resources is a financial services company. It offers a broad suite of services, and has over $770 billion in assets under management. Franklin Resources is a highly diversified company. It is diversified both in terms of its financial services as well as geographic regions. The company has offices in 35 countries and operations in more than 180 countries around the world.

Diversification by asset class:

Geographic diversification:

Type of investor diversification:

Franklin Resource’s diversification has helped the company generate steady growth over a prolonged period of time. Over the past 10 years, Franklin Resources grewearnings-per-share by 5.9% compounded annually. Its earnings growth allowed the company to increase its dividends declared by 14% compounded annually in the same period.

Leave A Comment