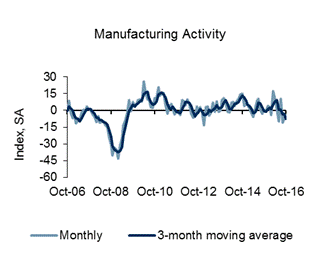

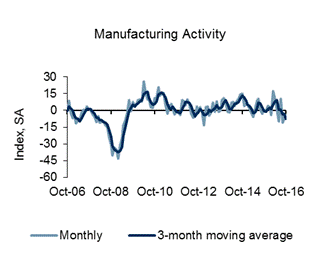

Of the three regional Federal Reserve surveys released to date, one is in expansion and two are in contraction.

Analyst Opinion of Richmond Manufacturing

We have a mixed picture of manufacturing across the fed districts. This report shows extremely low employment – and new orders and backlog improved but are also in contraction. At this point it seems the surveys are forecasting flat growth for September.

There were no market expectations from Bloomberg. The actual survey value was — [note that values above zero represent expansion].

Fifth District manufacturing activity remained sluggish in October, according to the most recent survey by the Federal Reserve Bank of Richmond. New orders and backlogs decreased this month, while shipments flattened. Hiring activity strengthened mildly across firms and wage increases were more widespread. Prices of raw materials and finished goods rose more quickly in October, compared to last month.

Firms looked for better business conditions during the next six months. Manufacturers expected positive growth in shipments and in the volume of new orders. In addition, manufacturers looked for rising backlogs of new orders. Producers anticipated increased capacity utilization and looked for slightly longer vendor lead times.

Survey participants’ outlook for the months ahead included moderate growth in hiring, while future wage increases outweighed declines in the October expectations index. Producers anticipated somewhat longer average workweeks. Firms expected faster growth in prices paid and prices received.

Current Activity

Overall manufacturing conditions remained sluggish this month. The composite index for manufacturing remained negative; however, the index added four points to end at a reading of ?4. The new orders indicator also remained negative this month, ending at a reading of ?12, while the shipments index flattened to a reading of 2. The manufacturing employment index moved up to a positive reading, adding 16 points to end at 3.

Backlogs decreased in October, with the index settling at ?11. The capacity utilization index remained negative; however, it decreased at a slower rate compared to last month as the index ended at ?5. Vendor lead time lengthened slightly this month, with that index adding two points to end at 7. Finished goods inventories rose across more firms than they fell, although the index lost two points, ending at a reading of 18. Similarly, growth in raw materials inventories outweighed declines in October, with that indicator remaining positive but moving down three points to 22.

Leave A Comment