Cincinnati Financial (CINF) is one of just 17 publicly traded businesses to have increased its dividend payments for over 50 consecutive years in a row.

In total, Cincinnati Financial has paid increasing dividends for 54 consecutive years.The company was founded in 1986, and currently has a market cap of $9.9 billion.

The company operates under four insurance lines:

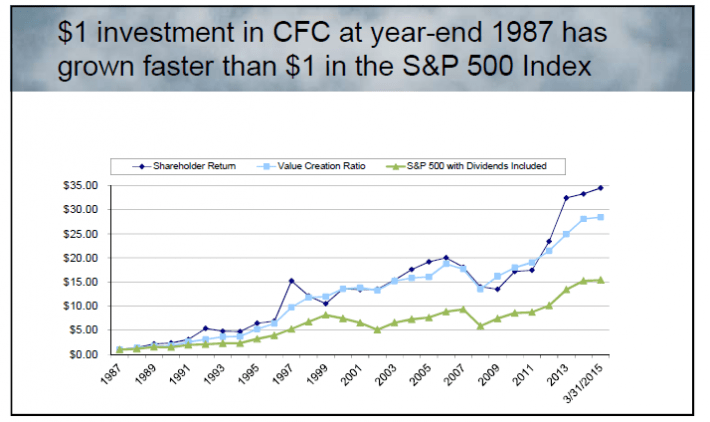

Cincinnati Financial’s performance since 1987 has been impressive.The company’s performance relative to the S&P 500 since 1987 is shown below:

Source: slide 27

Cincinnati Financial’s strategy to grow shareholder wealth is different than the previous 2 Dividend Aristocrat insurers I’ve analyzed [Chubb (CB) and Aflac (AFL)].

Chubb & Aflac seek to maintain low combined ratios (highly profitable insurance policies).They use the significant cash flows from their operations to repurchase shares.They also both maintain very conservative (mostly debt securities) investment portfolios.

Cincinnati Financial has a different strategy.The company’s goal is to maintain a combined ratio between 95% and 100%.This means it looks to write barely profitable – or even break-even – insurance policies.The company looks to provide returns for investors through growing the size of its operations and paying sizeable dividends, rather than spend the bulk of cash flows on share repurchases.

Over the last 3 years, Cincinnati Financial’s payout ratio has averaged around 60%.The stock currently has a 3.0% dividend yield, which is very high for the insurance industry.

Over 30% of Cincinnati Financial’s investment portfolio is invested in dividend growth stocks.Over the long-run, Cincinnati Financial’s investment portfolio will realize greater growth than its more risk-averse rivals.The company’s approach to investing its insurance float is more comparable to Berkshire Hathaway (BRK-A), rather than its Dividend Aristocrat insurance peers.

Leave A Comment