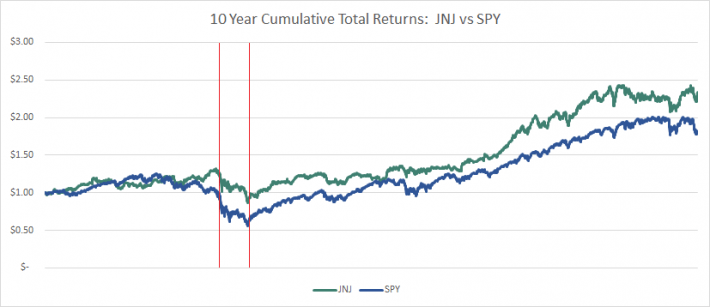

The image below shows the 10 year cumulative returns of Johnson & Johnson (JNJ) and the S&P 500 (SPY):

Source: Data from Yahoo! Finance

$1.00 invested in Johnson & Johnson on 1/27/2006 is worth $2.33 versus $1.82 for the same investment in SPY (both include reinvested dividends).

A large part of Johnson & Johnson’s outperformance over the last decade is because the stock fell less during the Great Recession (the red bars in the image above).

There are plenty of investments that outperformed Johnson & Johnson over the last decade – but beating the market is nothing to sneeze at.

There’s a hidden value to Johnson & Johnson stock not reflected in its return…

The company is an exceptionally low risk investment. Compare Johnson & Johnson’s stock price standard deviation to that of the S&P 500’s over the last 10 years:

It’s true, standard deviation is not real risk, but it is a proxy for risk that is a good predictor of how easy or difficult a stock will be to hold.

The lower the standard deviation, the lower (on average) declines during recessions – and the less likely investors are to panic at the worst possible time.

Johnson & Johnson has delivered greater returns with lower risk as compared to the S&P 500 over the last decade.

That’s a claim few businesses can make.

Get To Know Johnson & Johnson

Johnson & Johnson was founded in 1886. Since that time, Johnson & Johnson has grown to become the largest health care business in the world.

The company currently has a market cap of nearly $280 billion and generated $17.4 billion in adjusted earnings in fiscal 2015.

Success is nothing new to Johnson & Johnson. The company has paid increasing dividends for 53 consecutive years.

Source: Johnson & Johnson Pharmaceutical Presentation, slide 21

Johnson & Johnson’s long dividend history makes it 1 of 17 Dividend Kings. Dividend Kings are stocks with 50+ consecutive years of dividend increases – twice the minimum amount needed to be a Dividend Aristocrat.

Johnson & Johnson’s consistency comes from its wide diversification within the health care industry.

Leave A Comment