Nucor (NUE) has paid increasing dividends every year since 1973.

The company’s long history of steady growth is an anomaly in the volatile steel industry.

Nucor operates differently from other steel companies. What sets Nucor apart is the way it treats its employees.

The company has not laid an employee off in about 30 years. That fact alone speaks volumes about the company. Nucor rewards its employees based onhow productive they are – giving out generous bonuses to productive employees.

It should surprise no one that Nucor is non-union. This is a critical advantage the company has over its competitors.

Nucor’s primary competitive advantage is its employee compensation system. This results in more efficient and productive employees, and a more productive business in general.

Despite the company’s unique employee-based competitive advantage, Nucor has struggled over the last several years.

In 2006 Nucor had earnings-per-share of $5.73. In fiscal 2014, earnings-per-share were just $2.22. The company isn’t expected to break earnings-per-share highs set in 2006 until around 2019 (according to Value Line) – that’s 13 years of no growth.

What happened to Nucor? First, the company’s earnings and revenue fell off a cliff during the Great Recession. Secondly, imported steel is cheaper than domestic steel.

Imported Steel Overview

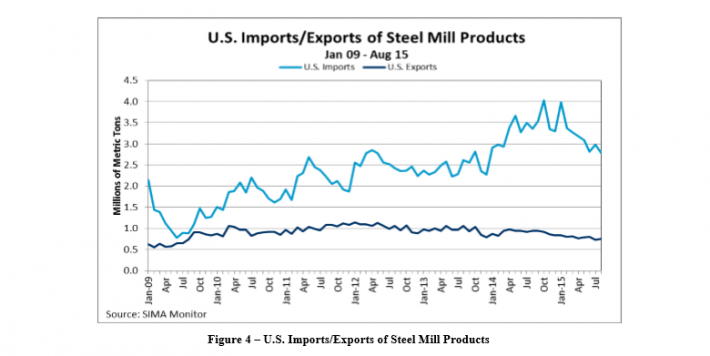

The amount of steel imported into the United States since 2009 has steadily increased. To be fair, some of this is due to greater demand for steel in the United States.

To a large extent, however, steel imports are rising because international steel tends to be significantly cheaper than domestic steel. The image below shows rising steel imports since 2009.

Source: October 2015 Steel Industry Executive Summary, page 4

The image below shows the top 6 countries from which the United States imports steel through the first 8 months of 2015:

Leave A Comment