November 2023’s dividend changes can be summarized pretty simply. Month-over-month, they were positive. Year-over-year, they were mixed.Overall, we find favorable dividend changes involving announcements of dividend increases and of special, or extra, dividend payments increased over October 2023’s levels. By the same token, we find November 2023’s unfavorable changes including decreased dividend payments and suspensions, or omissions, were down from the previous month. Both types of changes are positive for investors.Year-over-year however, there were fewer favorable changes, which is negative, but also fewer unfavorable changes, which is good. The following table presents November 2023’s dividend metadata for all these categories, with a Month-over-Month (MoM) comparison with October 2023 and a Year-over-Year (YoY) comparison with November 2022’s dividend metadata.

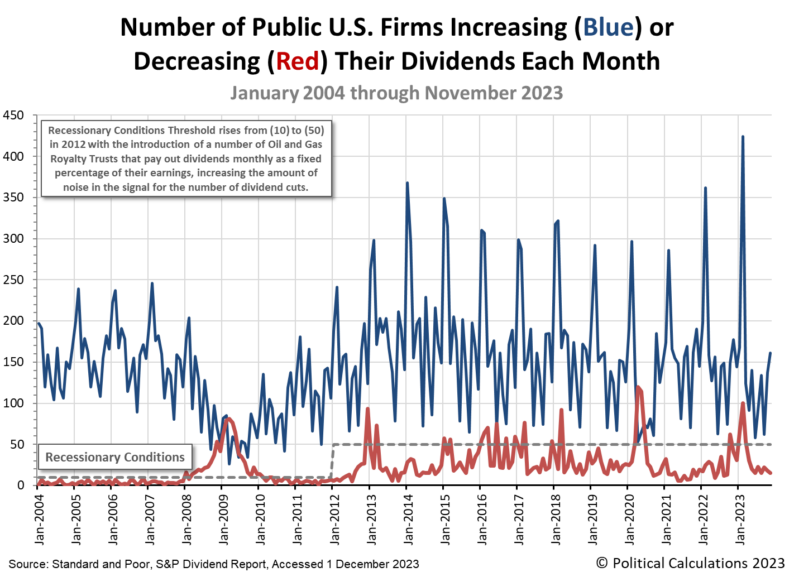

Standard and Poor’s data missed at least one resumption announced in November 2023, as PG&E (NYSE: PCG) resumed paying dividends for the first time since 2017.The following chart visualizes the monthly data for dividend increases and decreases as reported by Standard & Poor for each month from January 2004 through November 2023.chartOur sample of November 2023’s dividend declarations includes 12 of the 15 announced unfavorable changes. Here’s the list for the month:

Looking at the industrial sector representation, the real estate and shipping sectors tied for the having the most announced dividend decreases during November 2023 with three each. The oil and gas sector and the consumer goods sector added another two each. Finally there was one firm each from the banking and manufacturing sectors. Five of the twelve firms in November 2023’s sampling pay either variable or hybrid dividends, where the unfavorable changes reflect automatic adjustments compared to previous payouts that are tied to negative changes in their revenues and earnings. The number of dividend decreases announced by variable dividend payers is also well below the threshold that indicates anything more significant than typical month-to-month noise in these measures are behind the unfavorable changes.ReferencesStandard and Poor. S&P Market Attributes Web File. [Excel Spreadsheet]. 1 December 2023.More By This Author:The S&P 500 Rises To Its Highest Point Of 2023 As Gloomier Outlook Puts 2024 Rate Cuts In View Median Household Income In October 2023 New And Revised Data Suggests Possible Negative Change In Trend For U.S. New Home Market Cap

Leave A Comment