After the last two weeks, we suspect that a lot of investors are looking for a silver lining in the stock market. If that’s you, we may have something for you, because the new year got off to a strong start for dividend paying stocks in January 2018.

That strong start follows the rebound for the number of dividend paying stocks that began in 2017. Better still, the passage of the Tax Cuts and Jobs Act in December 2017 has the potential to continue that momentum well into 2018, even with the market’s dramatic correction after a long sustained rally.

Let’s go through the dividend numbers for January 2018:

There were 2,734 U.S. firms that issued some kind of declaration regarding their dividends in January 2018, which is down from 3,019 a year ago. That follows December 2017’s 4,506 declarations, which is the highest ever number of declarations recorded in data that goes back to January 2004. An important thing to note is that dividend declarations are typically issued several weeks before companies actually pay dividends to their shareholders, which means that many of these dividends would have been paid out in January 2018, which would be a direct result of the new tax law.

51 companies announced that they would pay an extra, or special, dividend payment to their shareholders in January 2018, down from 57 a year earlier.

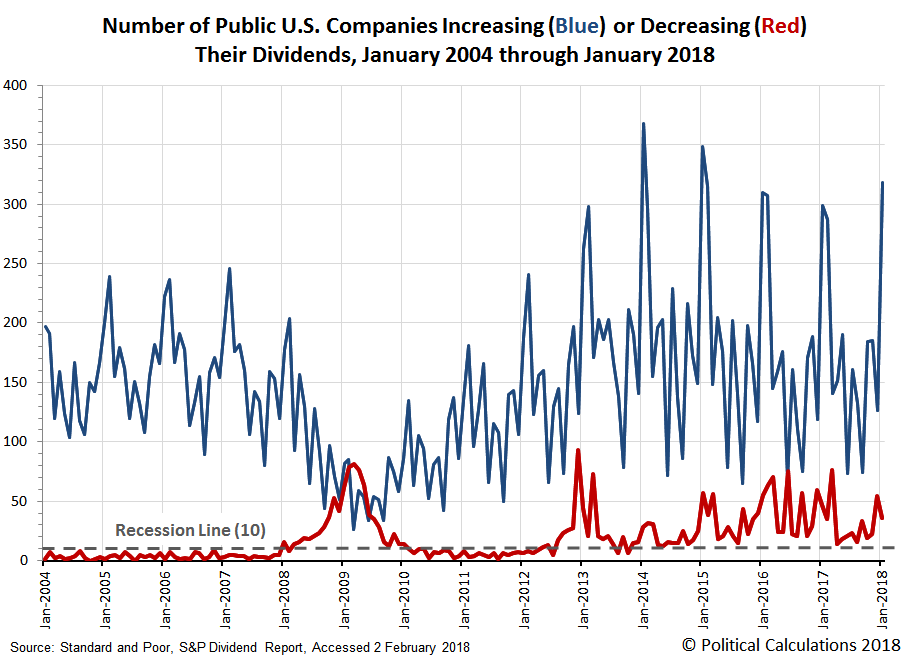

January 2018 saw 318 U.S. companies declare that they would increase their dividends, which is the third highest figure on record. That number is up from the year-ago number of 299.

If you’re looking for bad news, January 2018 had 36 U.S. firms announce that they would reduce their dividends. Even though that number is elevated, it was down significantly from the 47 recorded in January 2017, and is also the best January since 2014, when 28 U.S. firms announced dividend cuts.

In January 2018, only 1 U.S. firm omitted paying dividends for the month, down from 2 back in January 2017, but more importantly is the lowest number recorded in a January since 2013, when no U.S. companies omitted paying dividends to their shareholders.

Leave A Comment