This is a guest post from Tom Vilord of Wall Street Value.

If you have some cash to allocate into stocks, it is very difficult to find opportunities in this market. As I write this article (July 12, 2017), I received a CNBC text alert that the Dow just hit another record high.

With such high total market valuations, a lot of investors look for dividend paying stocks to find some yield. On the surface, this may seem like a very good idea. Most of the names in the Dividend Aristocrats portfolio are the large blue chip stable companies, that pay decent dividends, and historically have less volatility than the market as a whole.

Here are a few of the names in that portfolio that I really like: Johnson and Johnson (jnj), Kimberly Clark (KMB), 3M (MMM), Lowes (LOW), and Grainger (GWW). Every one of these companies have Financial Strength Ratings of A+ or A++ on Value Line. A++ is their highest rating. However, just because they are very financially stable companies with nice dividends, doesn’t mean you should just go ahead and invest your money in them because you can’t find opportunities elsewhere. DO NOT CHASE YIELD. I see a lot of investors buy into these types of stocks simply for the dividend and that could have huge consequences.

If you have read some of my previous articles, you will notice that I am a HUGE fan of Disney (DIS). They have great history of paying dividends, they have an A++ Financial Strength rating, their products and services are amazing, and could be a very good choice for the dividend investor. In 2015 I was looking into the company because I was hoping to move some proceeds from another investment into DIS. I did my analysis and one of the first things I looked wanted to find out was what did their normal historical valuation look like in terms of Price to Earnings.

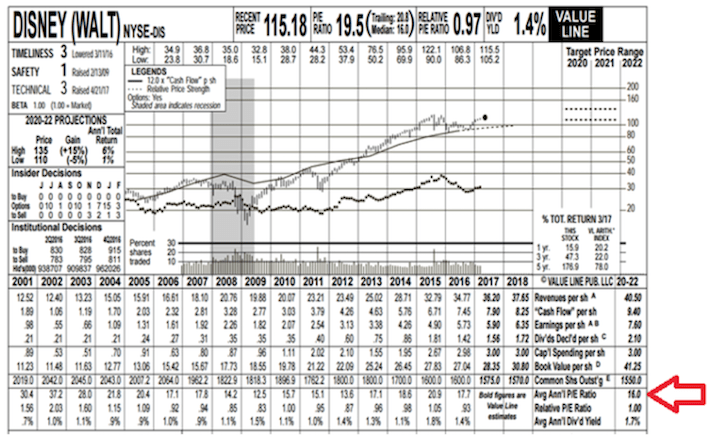

I looked at 2 time periods: I looked at their 10 Year Average PE and their 5 Year Average PE. This gives me an idea of what a potential “Normal” valuation would look like based on their own history. Since they are a predictable company that has had the same products and services 5 and 10 years ago as they do now, I think this valuation method can be pretty accurate for this type of business. Their 10 Year Average PE is 16.3 and the 5 Year Average PE is slightly higher at 17.5. So, a normal valuation for DIS is somewhere in the range of 16 to 17.5. When the stock trades at a PE in that range, I would say it’s fairly valued based on their own history. I don’t want to buy a fairly valued stock. I want to buy it at a discount, so I would have to buy the stock when it is well below a PE of 16.

Source: Dividend Aristocrats

When I did this analysis in November of 2015, their PE was 24.9. At that time, the stock was around $120. That PE is about 50% higher than the 10 Year average PE. To put that into perspective, the last time DIS was that overvalued was in 2003 when the PE peaked at 28 (Source: Value Line Above). When anything gets that overvalued, it will come back down to normal valuations. That is exactly what happened in February 2016. DIS fell from approx. $120 down to $85 as you can see in the Think or Swim chart below.

Leave A Comment