There May Be Gains To Capture In Stocks In The Coming Years, But Risk Management May Be Very Important Down The Road

While pondering the recent shift in market sentiment/hard data, along with the possible ramifications for investors, we ran across the quotes below in an October 26 Bloomberg article:

“Central banks are playing catch up with what the market has known for some time – that global growth is slowing,” said Jason Daw, head of Asia currency strategy at Societe Generale SA in Singapore.

“While inflation is this low at a global level, central banks will step on the gas again and elevate asset prices for the foreseeable future,” Deutsche Bank AG strategist Jim Reid said in a note to clients on Monday. “This leaves a huge gap risk lower for financial markets, but that’s more of a problem for when central banks are unable or unwilling to act.”

The key takeaways from the quotes above:

Central Banks Are Not Going Away

Every once in a while someone summarizes the big picture in a simple way. Bill Gross, formally with PIMCO, noted the following in his December 2013 investment outlook:

Don’t fight central banks, but be afraid.

Why is this statement so relevant? The market’s pricing mechanism is driven by both fundamental and speculative forces. Speculators are not evil; in fact, they provide much needed liquidity for efficient pricing. A healthy market has a relatively even mix between fundamental forces and speculative forces.

Markets that have “excess liquidity” compliments of central banks become skewed toward the speculative end of the spectrum.

Speculative Markets Can Rise For Years

Many will say “I do not want to participate in speculative markets”, which seems logical. However, if we told you the stock market was going to rise for two more years, would you want to participate? The logical answer is yes if there is money to be made. Those who lived through the dot-com and housing bubbles can attest to the accuracy of the statement “speculative markets can continue to rise much longer than rational people believe.”

2015: The Evidence For A Sustained Rally Has Been Piling Up

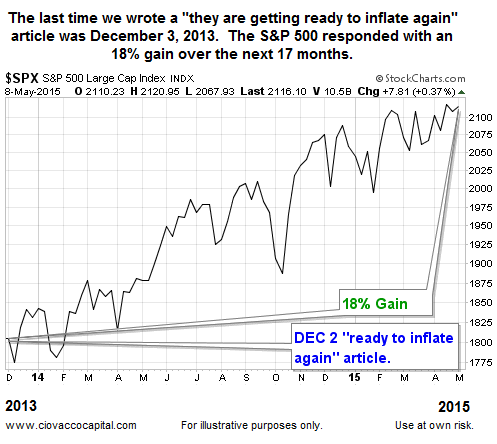

Bill’s Gross’ don’t fight, but be afraid comments were published in December 2013, just before the 18% pop in stocks. Are we saying the S&P 500 is about to rally an additional 18%? No, we are saying “they are getting ready to inflate” conditions today are similar to the tone in December 2013. This week’s video walks through the evidence that has accrued since the October 2 intraday “key reversal” in stocks, along with an examination of the major shift that helped spark the rally.

Leave A Comment