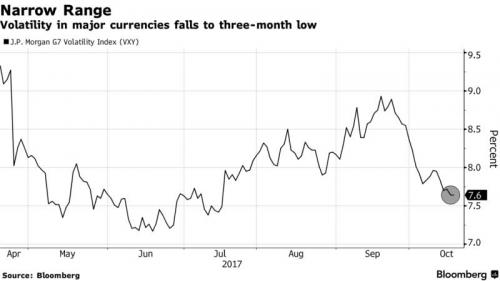

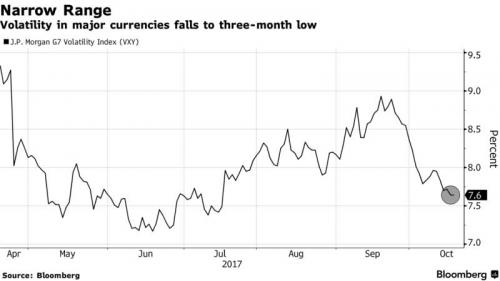

World stocks stayed near peaks and currencies moved in tight ranges on Wednesday as China’s 19th Communist Party Congress opened while focus in Europe turned to speeches from top euro zone central bankers before next week’s key policy meeting, as well as Catalonia’s ultimatum due on Thursday. S&P futures are solidly in the green as usual, with Dow futures jumping above 23,000, driven higher by IBM as investors looked for new reasons to extend gains after hitting new all-time highs Tuesday. The dollar continues to strengthen, buoyed by speculation that the next Federal Reserve chair will be more hawkish, as volatility in major currencies fell to a three-month low, while Treasury yields rose.

Among the factors contributing to today’s burst of risk on buying is the continued bid in USD, which has forced markets into hybrid risk-on mode according to Bloomberg. EUR/USD and GBP/USD push through yesterday’s session lows, which consequently supports domestic equity markets via exporters and multinationals. Rally in USD/JPY pressures USTs, dragging down core fixed-income markets; UST/bund spread wider by 1.6bps. U.S. equity futures also supported, Dow futures test 23,000; crude futures hold small gains after bullish API data.

European stocks are on fire, with the Stoxx 600 heading for its biggest rise in 2 weeks as the euro weakened for a fifth day on speculation the ECB will remain accommodative even as it tapers asset purchases, while volatility slid; the Stoxx 600 gained 0.4% while euro falls back to $1.1750 and VStoxx hits intraday record low. Technology, food and beverage best performers among industry groups, all 19 sectors in green; DAX hit another record high. The European vol index, the VStoxx dropped as much as 8% to 10.7, the lowest level on record. bond yields fell ahead of a series of speeches from top European Central Bank officials before next key policy meeting on Oct. 26.

Looking at European stocks, BNP Paribas Wealth Management CIO Florent Brones said that “there are many positive elements supporting the euro-area stock market at this point, and while the market has been rallying, we’re not yet seeing double-digit gains.”

European Central Bank chief Mario Draghi, Chief Economist Peter Praet and Executive Board Member Benoit Coeure are among those officials scheduled to speak. First remarks from Draghi at a conference in Frankfurt had limited initial market impact. “Today, bond market investors will probably concentrate exclusively on the various ECB speakers, who could influence market expectations for the last time ahead of next week’s meeting,” said ?BayernLB rate strategist Alexander Aldinger.

The MSCI’s Asia-Pacific index ex Japan was flat, near its late 2007 peak after China President Xi Jinping kicked off the twice-a-decade party congress with a wide-ranging speech, in which he warned of “severe” challenges while laying out a road map to turn the country into a leading global power by 2050. Investors are watching to see whether Xi will push through tough reforms as the world’s second-largest economy faces structural challenges over the next five years. Jinping said the market would be allowed to play a decisive role in allocating resources but also said the role of the state in the economy had to be strengthened.

“His speech offered nothing to move the markets in Asia,” ?Bayern LB’s Aldinger also said. Investors are looking for clear direction on economic and financial market reform over the next five years, but as has been the case in history, the actual speech was light on detail.

China’s CSI300 index added 0.8 percent in reaction, while Shanghai stocks rose 0.3 percent. “Market participants are paying much more attention to the party congress this time, as they are watching if any surprise reforms will emerge amid concerns over economic growth,” said Yan Kaiwen, analyst with China Fortune Securities.

Still in Asia, Japan’s Nikkei rose for a 12th consecutive day, getting a lift from hopes that this weekend’s election will produce political stability and continuation of loose monetary policy even as technical indicators suggest the gauge is overheating. An opinion poll by Kyodo showed Japanese Prime Minister Shinzo Abe’s coalition was on track for a roughly two-thirds majority in Sunday’s general election there. The 14-day relative strength index stood above 70 – a level frequently seen as overbought – for an eighth day, while the Toraku Index, a barometer of momentum, climbed to 128, far higher than the 120 level that signals the Topix is poised to fall.

“The Japanese stock market may be on alert for high prices and stay in a narrow range,” said Mitsushige Akino, an executive officer with Ichiyoshi Asset Management Co. in Tokyo. “Yet business sentiment is on a firm footing not only in the U.S. but also globally.” Pharmaceutical stocks and automakers were among the biggest boosts to the benchmark gauge, while banks and services companies weighed the most. About two stocks fell for every one that rose. The Nikkei 225 Stock Average extended its winning streak, the longest since June 2015, boosted by Fast Retailing Co. and Astellas Pharma Inc. The Topix has gained 2.5 percent in an 8-day rally, boosting its advance this year to almost 14 percent. It trades at 15.3 times estimated profits for the next year, well below the high of 20.5 reached in March 2013 and compared with the S&P 500 Index’s 19.4 times. “Valuations are low, both compared to other global markets and particularly so when taking account of the 0% yield on 10yr government bonds,” said Nicholas Smith, a strategist at CLSA Ltd. in Tokyo. “Sure, over the short-term it might have a pullback, but I think the fundamentals are excellent and the market is pricing in the decreased uncertainties that go with Abe stronger for longer.”

In currencies, the dollar edged up amid speculation President Trump could chose a more hawkish leader to replace Federal Reserve Chair Janet Yellen, while investors awaited for any news on progress on U.S. tax reforms.The dollar index rose 0.07 percent to 93.54, extending a rebound from Friday’s 2 1/2-week low of 92.749. It rose as high as 93.729 on Tuesday. The onshore yuan predictably strengthened against the dollar as the 19th Party Congress began in Beijing while the U.S. Treasury’s twice-yearly report softens China FX criticism. The PBOC injected a net 270 billion yuan of liquidity helping the Shanghai Composite 0.3% higher. Australian 10-year yield drops to a one-month low of 2.72% as the curve extends bull-flattening; Treasuries steady. Canadian dollar outperforms G-10 peers after Nafta negotiators agree to extend talks into next year; kiwi slips following weaker Fonterra milk price auction. WTI crude holds above $52; Dalian iron ore futures gain 2.2 percent

Leave A Comment