Gary Antonacci may not be happy to learn that his “Dual Momentum” label has been pirated by a team of academics (Huang, Zhang, and Zhou)(1)(2) in a new paper that explores the combination of price and fundamental momentum stock-picking strategies. The authors also investigate the common rebuttal that transaction costs destroy stock momentum strategies. The authors perform a variety of robustness tests and their results are strong and significant. The author’s describe their results best (regarding stock-selection momentum):

Dual momentum is not attributable to transaction costs.

Can a stock-picking focused dual momentum approach dethrone the asset-level dual momentum approach outlined by our friend Mr. Antonacci?

Photo taken during a summit of Mt. Shingle in the Flattops wilderness of Colorado. Many quantitative finance arguments were discussed.

In this post we explore and explain the results from this new paper and encourage readers to read our summary and the underlying paper to make their own decisions.

Let’s dig in…

Fundamentals Momentum and Price Momentum

Jack did a nice recap on a momentum paper last week that looks at using fundamentals (revenue volatility, low cost of goods, and B/M) to help identify the best price momentum stocks.

This paper sounds similar to the paper Jack reviewed, but there is a key difference: the researchers are looking at the momentum of the fundamentals, not the absolute value of the fundamentals. The authors compile a fundamental momentum variable by calculating the moving averages of 7 elements:

The 7 measures are combined in a three-step regression process to create a fundamental implied return, or FIR. One can think of their process as a rudimentary machine-learning approach that uses the trend in fundamentals to predict future stock returns. The authors then use their FIR metric to identify long and short portfolios.

Price momentum portfolios are generally formed based on the past 12 month cumulative returns (skipping the most recent month)(3).

How Do Fundamental Momentum and Price Momentum Perform?

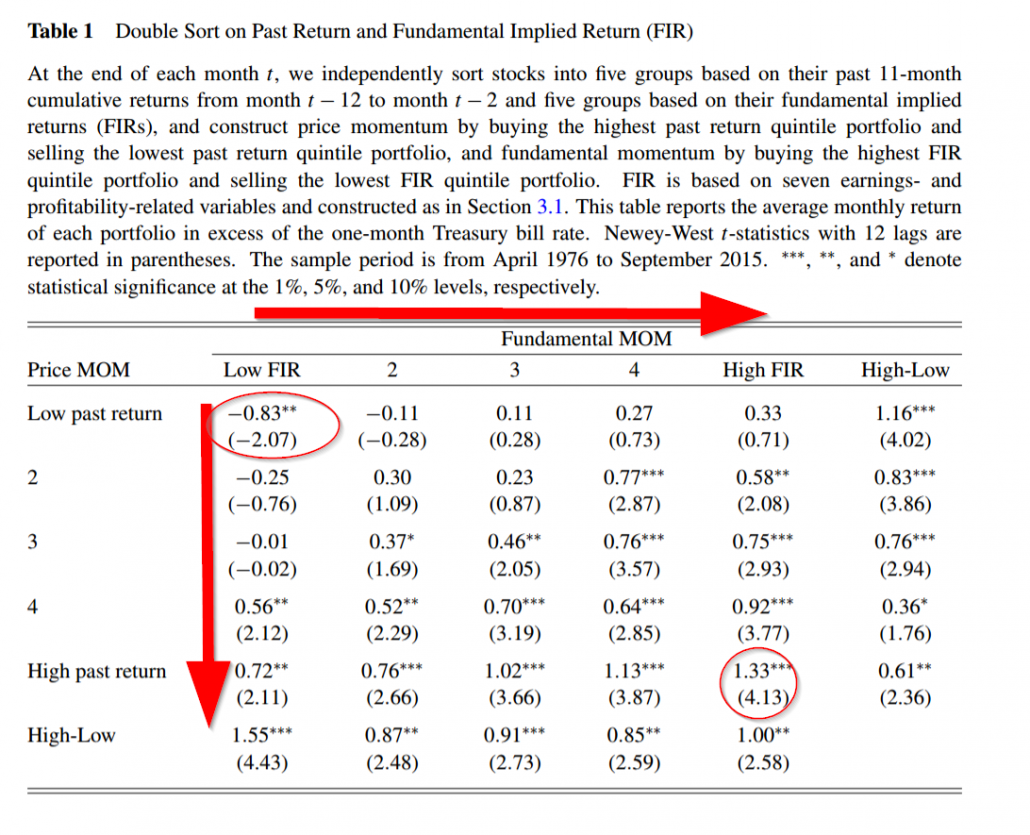

The authors look at the performance of independent sorts on fundamental and price momentum.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Leave A Comment