While Fed Funds futures imply a 100% probability that the Fed hikes rate by 25bps tomorrow, it appears questions over Trump’s policy timeline combined with the collapse in GDP expectations has dragged expectations for another rate hike in June back to its lowest since the election…

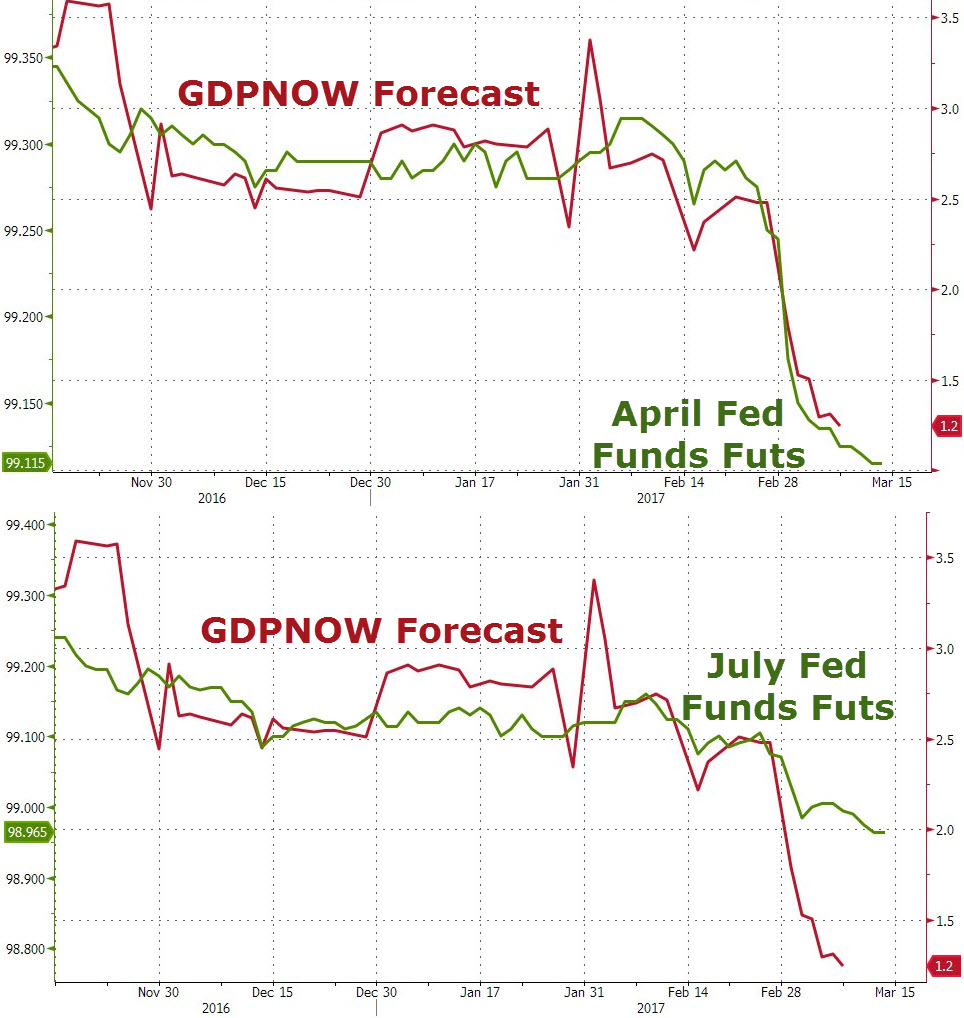

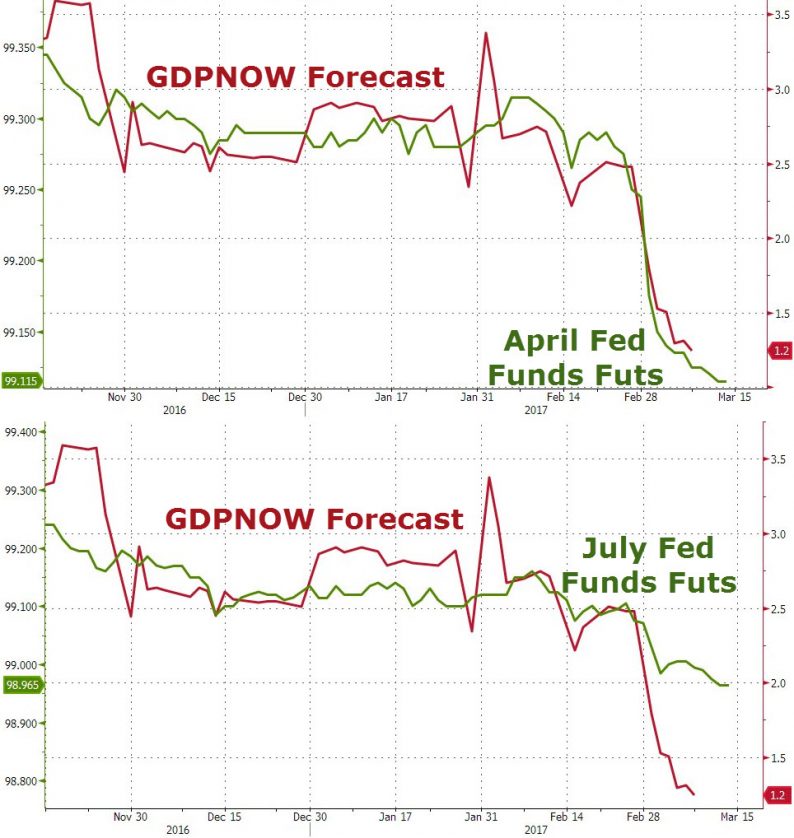

As GDP growth expectations have plunged so April Fed Funds futures have tumbled – completely against the common sense that the Fed hikes into strength, not weakness…

But the lower chart shows the July futures not following the collapse and fading that disappointment.

For some context, if the current Atlanta Fed GDPNow forecast is correct and first-quarter growth is a mere 1.2%, that would tie as the second-weakest quarter since 1987 in which rates were raised, according to Julian Emanuel at UBS who added:

“When also considering the potential for retail fund flows to slow down as tax season (April 15) approaches, the realization that economically stimulative legislation in Washington DC may take longer and carry less “punch” than anticipated, and that political change in Europe (the French election is May 7) could prove disruptive, the expectation of a pullback consistent with past macro episodes is reasonable over the next several months.”

This translates into a notable drop in the odds of an additional Fed rate hike in June…

Of course, with The Fed determined, we are sure they will manage to jawbone this up also – no matter how un-dependent on data they become.

It is abundantly clear that The Fed is more dependent on smoke and mirrors data than real economic growth…

Leave A Comment