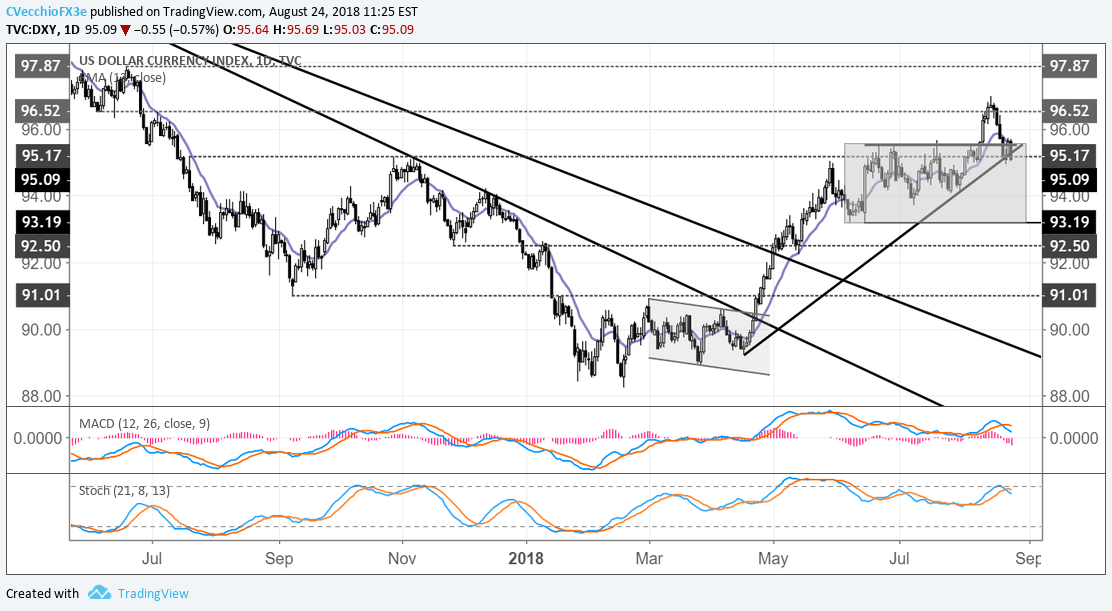

The US Dollar (via the DXY Index) is closing in on its lows of the week established on Wednesday as traders are heading into the weekend disappointed by what they’ve heard so far at the Jackson Hole Economic Policy Symposium. As a result, the DXY Index may be poised to break trendline support going back to the late-April swing lows.

Fed Chair Jerome Powell’s speech at the Jackson Hole Economic Policy Symposium provided no support for the US Dollar as he noted that the gradual pace of rate hikes remains appropriate, leaving market pricing unchanged for the timeline of when the Fed will move next.

Noting that the economy’s “strong performance will continue” against a backdrop where there “does not seem to be elevated risk of overheating,” Fed Chair Powell said that the “gradual process of normalization remains appropriate.” For now, this means a 25-bps rate hike at meetings in which a new Summary of Economic Projections is produced.

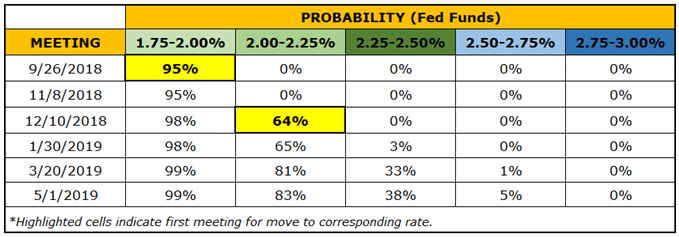

Federal Reserve Rate Hike Expectations (August 24, 2018) (Table 1)

Currently, Fed funds futures are pricing in a 95% chance of a 25-bps rate hike in September, and a 64% chance of another hike in December (bringing the total to four 25-bps hikes in 2018). Beyond that, however, rates markets aren’t pricing in another move until June 2019.

Today’s price action in the DXY Index surrounding Fed Chair Powell’s speech is another piece of evidence in the case for the US Dollar topping out. Rates markets can’t get more aggressive than they already are for the September meeting, essentially saying that this bullish driver has been exhausted.

DXY Index Price Chart: Daily Timeframe (June 2017 to August 2018) (Chart 1)

As we suggested a few days ago, there is ample reason to believe that the US Dollar is topping out in the near-term from the technical perspective as well. The false breakout that materialized in July and August has now pushed prices below the rising trendline going back to the late-April swing low. At the same time, price is now trading below its daily 8-, 13-, and 21-EMA envelope, while both daily MACD and Slow Stochastics have continued to turn lower.

Leave A Comment