Tiffany & Co. (TIF) has been a winning trade on our part. We believed that Tiffany & Co. was offering growth at value prices and we highlighted the name a year ago as a ‘Diamond on Sale.’ Recently it was our view that the stock had now given us a solid return, and it was time to go buy something nice. To be clear, we said that you should take some profits and let the rest run.

In this column, we want to check back in on the name as we hold a core position. It is our thesis that while we continue to like the name long-term, shares are a bit ahead of themselves for a new purchase. Given the historical volatility in the name, however, we believe that you will get the chance buy shares in the luxury retailer in the future. Overall, we think performance is very solid. Let us discuss the performance and our thoughts on valuation.

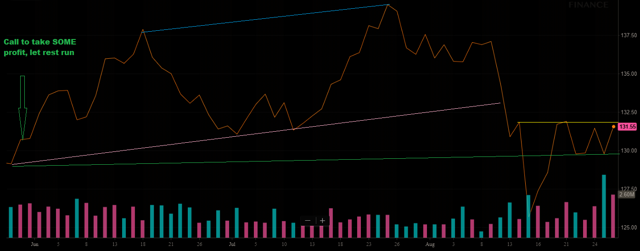

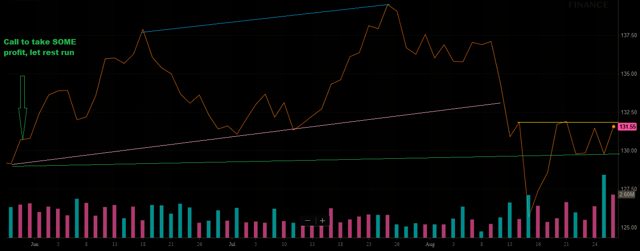

Recent price action suggests stock is searching for direction

There is no doubt that we saw a hefty gain in the name in the last year. Recall there was a huge gap up following Q1 earnings, prompting us to take profits. Since then shares are about flat, but we did miss out on a few more points of gains:

Source: BAD BEAT Investing

While there have been ups and downs, the overall move has been higher, until recently. We continue to believe shares are a touch ahead of themselves right now, even though recent performance is strong, including in Q2. Our chartist believes the stock is searching for direction in recent sessions, and another break below $130 or a gap up above $135 would be bearish, or bullish, respectively. However, it is unclear at this time on the shorter-term chart. Longer-term the stock is still in an uptrend. With this information at hand, let is turn to the fundamentals.

Fundamental discussion

As the economy continues to be solid in North America and in key markets of Asia, in addition to the fact that there is more money in the pockets of higher-end consumers thanks to the recent tax cuts in the U.S, Tiffany & Co. registered another solid quarter. While retail has been painful in general the last two years, the stronger names have been in rally mode in the last 6-8 months. Tiffany is one of these names, as it has performed very well, both operationally and from a shareholder’s perspective.

We must acknowledge however that some weakness persists in certain lines of operations within the Tiffany enterprise. However, even with this weakness, the company is demonstrating that it is still a strong, profitable retailer. So, how was the just released Q2? In short, the company’s second quarter was solid. We were looking for strong sales but were once again surprised by the magnitude of the increase here.

Leave A Comment