A Ranking system sorts stocks from best to worst based on a set of weighted factors. Portfolio123 has a powerful ranking system which allows the user to create complex formulas according to many different criteria. They also have highly useful several groups of pre-built ranking systems, I used one of them the “Momentum Value” in this article.

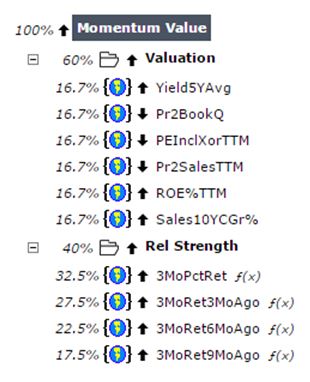

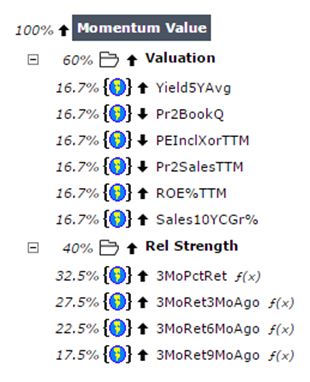

The “Momentum Value” ranking system is quite complex, and it is taking into account many factors like; yield, price to book value, P/E ratio, price to sales, return on equity, sales growth and relative strength. This system finds value plays with prices moving upwards. The rank is a combination of value factors and momentum factors. The value factors make up 60% of the rank and the momentum factors make up 40% of the rank, as shown in the Portfolio123’s chart below.

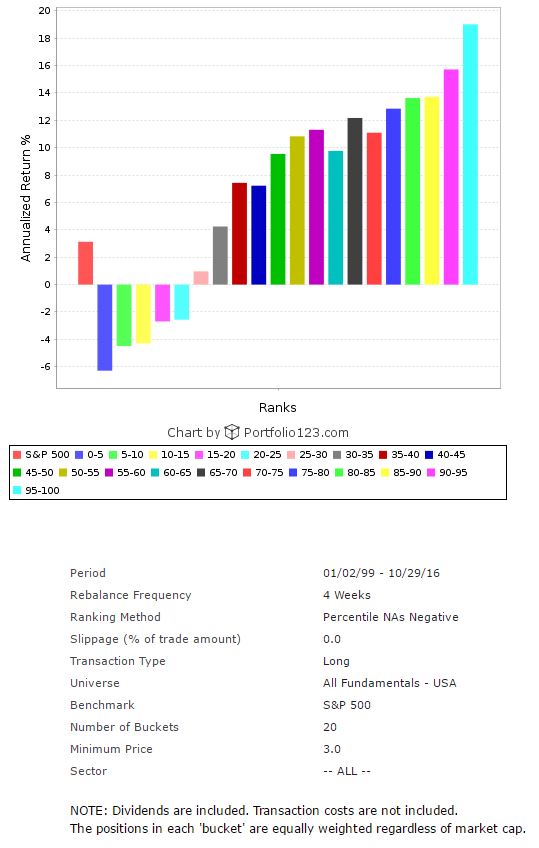

In order to find out how such a ranking formula would have performed during the last 17 years, I ran a back-test, which is available by the Portfolio123’s screener. For the back-test, I took all the 6,287 stocks in the Portfolio123’s database.

The back-test results are shown in the chart below. For the back-test, I divided the 6,287 companies into twenty groups according to their ranking. The chart clearly shows that the average annual return has a very significant positive correlation to the “Momentum Value” rank. The highest ranked group with the ranking score of 95-100, which is shown by the light blue column in the chart, has given by far the best return, an average annual return of about 19%, while the average annual return of the S&P 500 index during the same period was about 3.1% (the red column at the left part of the chart). Also, the second and the third group (scored: 90-95 and 85-90) have given superior returns. This brings me to the conclusion that the ranking system is very useful.

After running the “Momentum Value” ranking system on all S&P 500 stocks on October 29, I discovered the twenty best stocks, which are shown in the table below. In this article, I will focus on first-ranked stock of the system; Best Buy Co., Inc. (BBY).

Leave A Comment