A new equity crowdfunding platform called Fig is making waves with its unique investment offerings. On Fig, investors can back the development of video games. In return, they’re rewarded with shares of sales revenue. The company posted this handy infographic to show how

October 29, 2016

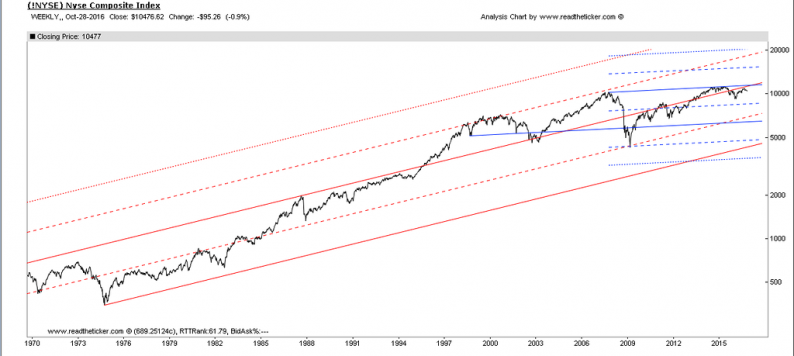

Friday’s out-of-the-blue FBI revelation of (essentially reopening) what is considered to be an ongoing investigation of impropriety shook not just the S&P, but importantly, the Russell, sufficiently to venture into a crucial last-ditch technical support zone I’ve alluded to these past two weeks (and