Mining giant Vale S.A.’s VALE reported robust third-quarter 2016 results. Quarterly adjusted earnings came in at 19 cents, exceeding the Zacks Consensus Estimate of 14 cents. The company had reported loss of 19 cents per share in the year-ago quarter.

Revenues

Net operating revenue rose 13% year over year and 11% sequentially to $7.3 billion.

Of total net operating revenue, sales of ferrous minerals accounted for 67.7%, coal contributed 2.2%, base metals comprised 21.6%, fertilizer nutrients made up for 8.2%. The remaining 0.34% was sourced miscellaneously.

Geographically, 16.3% of revenues were generated from South America, 55.7% from Asia, 7.5% from North America, 15.7% from Europe, 3.2% from the Middle East and 1.6% from Rest of the World.

Expenses

In the third quarter, cost of goods sold totaled $5 billion, down 1.7% year over year. Selling, general and administrative expenditure climbed 16.8% to $153 million, while research and development expenses plunged 29.8% to $85 million, both on a year-over-year basis.

Balance Sheet/Cash Flow

Vale exited the third quarter with cash and cash equivalents of $5.4 billion compared with $4.4 billion in the year-ago period. Non-current liabilities came in at $49.4 billion, up from $44.3 billion recorded a year ago.

Net cash from operating activities came in at $2.4 billion as against $1.6 million in the year-ago comparable period. Capital spending totaled $1.2 billion compared with $1.9 billion in third-quarter 2015.

Outlook

Vale expects to improve its financial fundamentals on the back of specialized cost-saving plans, productivity enhancement schemes, growth projects and superior mining yield, going forward. Moreover, the company aims to stabilize its absolute debt level in the coming quarters through efficient disinvestment programs and suitable capital-deployment strategies.

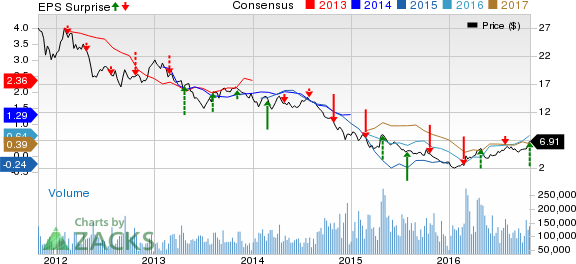

VALE SA Price, Consensus and EPS Surprise

VALE SA Price, Consensus and EPS Surprise | VALE SA Quote

Leave A Comment