Coca-Cola (KO) is one of the most globally recognized brands in the world. That said, it is not only the world’s largest beverage company even after divesting its bottling assets, but it also licenses/owns over 500 other brands. We are talking about various brands of water, sports drinks, dairy products, plant-based beverages, teas and more.

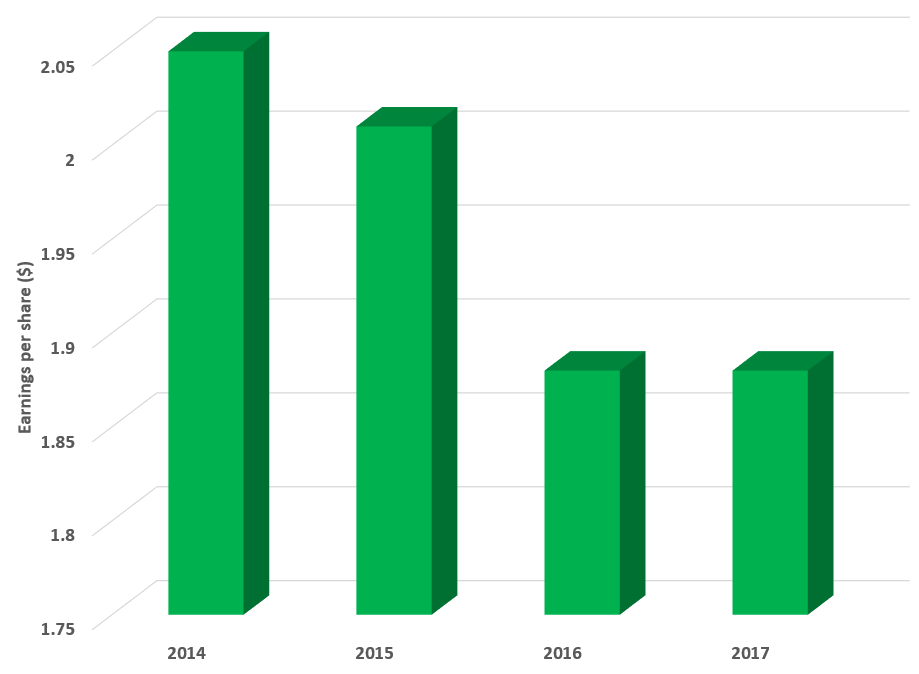

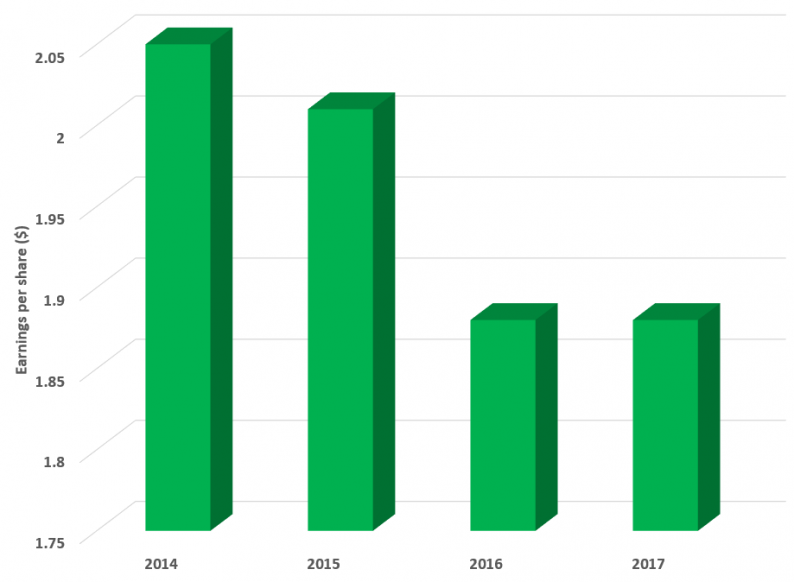

As the company has been in transition mode in recent years, it has seen pressure in sales and in earnings. We are specifically concerned with earnings. In this column, we will discuss both quarterly and annual earnings performance. We will show that performance has declined, but we believe it is stabilizing and is set to improve in 2018.

The company’s Q4 was rather strong. Q4 earnings per share came in at $0.39. This beat our estimate of $0.36 per share by $0.03, which we arrived at based on the trajectory of the company in 2016, expectations for a relative flat bottom line, share repurchases, and expense management.

These earnings were better than we expected. We believe the earnings improvement was a result of both higher organic revenues and better margins. We anticipated the latter as we foresaw strong expenses management.

or the year 2017 we were expecting $1.88 in earnings per share, while the company guided $1.87 to $1.91. The company saw earnings per share at the top end of this range:

As you can see earnings had trended lower, but now appear to be stabilizing. Looking ahead to 2018, we expect earnings growth, but not enough to justify buying at present valuations. The company is likely to see revenues stabilize in 2018 and rise 2-4%. We expect a slight benefit from tax reform in the United States.

For 2018, we see the completion the bottling operation divestiture process as likely. We also expect organic revenue growth of 3-4%. On an adjusted earnings per share basis, we think earnings could approximate $2.03 to $2.10. Even at our most bullish estimate, the stock is trading at 22 times forward earnings, and this is expensive given the lack of growth. We rate the name a hold and think you can add shares if the prices pull back to $40-$41.

Leave A Comment