One of the most reliable ways to forecast economic growth is to note carefully the changes in the rate at which credit grows. A steady increase in credit to households and businesses allows for economic expansion and rising incomes. Restraining credit growth curtails consumer expenditures and business expansion in the future.

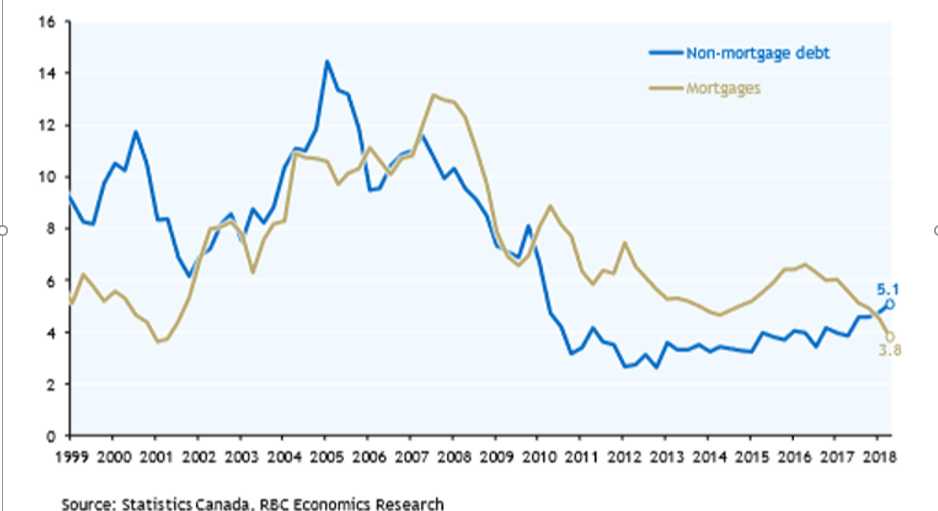

Canadian household credit growth is clearly slowing, especially in the past quarter, a sign that the economy will undergo a slowdown over the next 6-12 months. With mortgages occupying the largest single segment of consumer debt, it is noteworthy that Canada’s mortgage growth in the second quarter dropped by about a 1/3 compared to the same period a year earlier, hitting its lowest level since 2001 (Figure 1). This shift in gears was the aim of the Federal government when it introduced new mortgage rules and additional “stress tests” for Canadian mortgage borrowers. The new rules require that borrowers qualify for the loan at the Bank of Canada’s higher posted rate — currently 4.6%, compared to actual markets rates for a 5-year mortgage at 3.7%. The mortgage brokerage industry estimates that about 100,000 first- time home buyers would no longer be qualified for mortgages under these new rules.

Figure 1 Household Debt Canada, (Annual Percent Change)

Chart source: Arthur Donner, Ph.D., private memo

From the government’s perspective, it welcomes the news that Canadian household indebtedness is leveling off from rather elevated levels. Canada’s household sector has been deleveraging for the past two years, however at a cost of slower economic growth. The one exception is that house prices, especially in the Greater Toronto and Greater Vancouver markets, remain very elevated and have actually increased slightly in the past quarter. Higher mortgage costs do not play any real part in these two markets where the supply of land determine market prices, not the cost of borrowing.

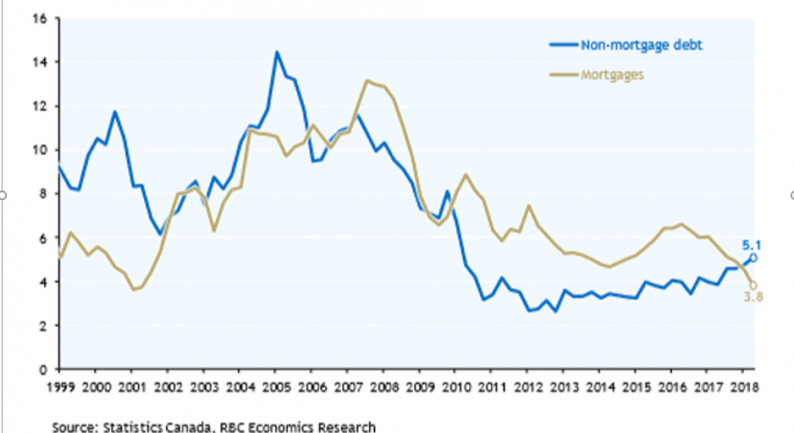

Perhaps of greater significance is the drop off in business credit conditions (Figure 2). Business credit growth has dropped from 13% annualized growth to less than 6% in the first half of this year. While tightening monetary conditions can account for some of this decline, no doubt the great uncertainty regarding Canada-U.S. trade relations and the slowdown in worldwide trade flows have introduced considerable caution in the board of rooms of the Canadian industrial sector.

Leave A Comment